Vontier (NYSE:VNT) is an industrial technology company offering technical equipment, software, and services in the mobility infrastructure space. The company was listed in October 2020 following a tax-free spinoff from Fortive (FTV), but the overhang from FTV’s residual ownership stake (FTV intends to sell within 12 months following the October spin) continues to weigh on Vontier’s valuation. While VNT’s long-term growth story remains a “show me” story, the stock at current levels is discounting a rather pessimistic outlook at only ~14x fwd P/E (vs. closest peer DOV at ~20x). On TTM numbers, VNT also looks set to clear an ~12% FCF yield, leaving ample capital allocation optionality.

Source: SeekingAlpha

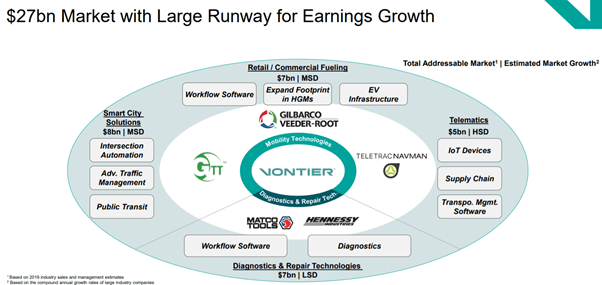

Chasing a ~$27bn Addressable Market

On the whole, Vontier sees a combined ~$27bn total addressable market across its two segments – Mobility and Diagnostics & Repair Technologies. This moves up to $30bn if we were to include the electric charger market. And this should grow over time – VNT sees a mid-single-digit % market growth outlook for integrated fueling infrastructure (i.e., GVR) and a low-single-digit % growth outlook for the diagnostics & repair segment.

Source: Investor Presentation

In the short term, Vontier is mostly levered to domestic markets, with growth mainly coming from increased vehicle complexity and technician shortages. But in the long term, VNT is well-positioned to evolve into a more diversified industrial technology player with substantially less reliance on retail fueling. Instead, Vontier is looking to pursue growth in evolving mobility infrastructure end-markets, leveraging its capable management team, business system/culture, and balance sheet to evolve the business portfolio toward the future of mobility/fueling.

A Multi-Year EPS Growth Story

Vontier’s range of growth opportunities across both legacy and newer businesses (that remain in their early phases of growth) supports a multi-year growth story, as well as a higher multiple, in my view. With a historically