The Business of Chuy's

Chuy's Holdings, Inc. (CHUY) operates casual dining restaurants across 92 locations in the United States. The fare at these locations is "made-from-scratch" Tex-Mex style dishes in an environment that Chuy's describes as "unchained", "irreverent" and "family-friendly". Chuy's owns all of its restaurants; it does not currently franchise any locations and doesn't have any plans to start.

Chuy's restaurants are primarily located in the mid-west with a handful of locations scattered along the east coast. The restaurant caters to consumers in the 21-44 age demographic.

The company has been fairly consistent, opening ~10 new locations each year between 2013 and 2018. They only opened 6 in 2019. They've also done a great job of keeping their restaurants open, closing only six locations since their founding (2019 10-K). All of those closings, however, took place in 2019.

While they have paused opening new locations due to COVID-19, they currently have 3 new locations underway, and they expect to open them in 2021.

Chuy's estimates that it costs roughly $3.5-$4.0 million to launch a new location, and they target 30% cash on cash returns for each new location by year 3. Historically, Chuy's has generated ~$4.5 million in annual revenue for each location.

A Quick Look at the Competitive Landscape

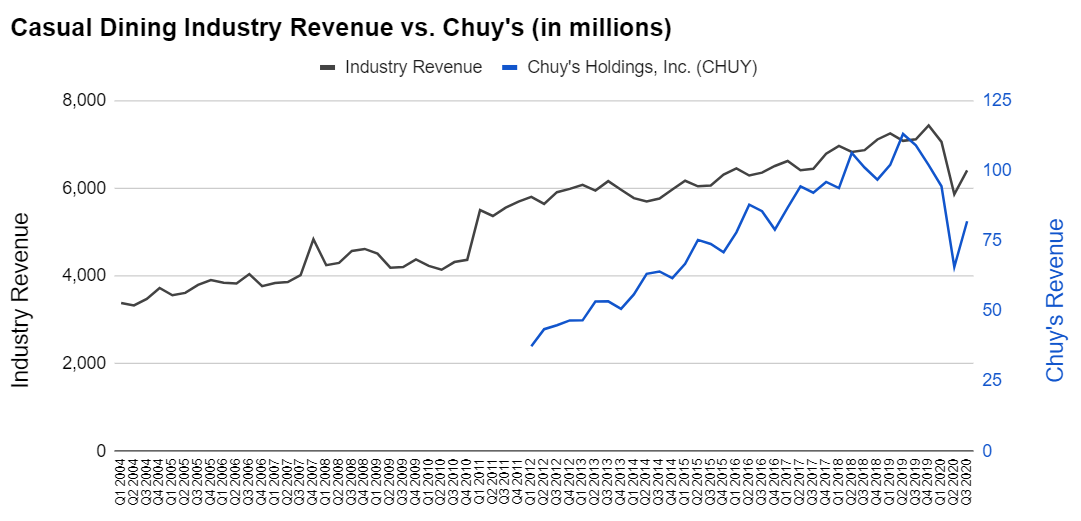

Casual dining has been a growing market for years. Below, I've prepared a chart plotting the aggregate revenue from the primary casual dining players (*see below) against the revenue of Chuy's. Note the scale differences on the chart, but with a quick glance, it is clear that Chuy's has been growing much faster than the segment.

*For the purposes of this chart and any other reference to the segment data in this write-up, I am compiling said data by aggregating the primary publicly traded competitors in the casual