This article was co-produced with Nicholas Ward.

This week, a telecommunications company made very big news.

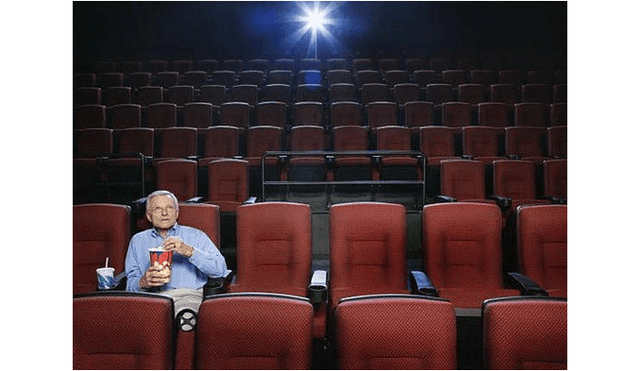

We're talking about the bombshell that AT&T's (T) WarnerMedia division dropped on the theater industry. Apparently, it will be releasing all 17 of its 2021-slated films to its HBO Max subscribers... on the same day they’re available in theaters.

Now, HBO Max is a domestic-only service, so international box office sales shouldn’t suffer. But certain U.S.-bound real estate investment trusts (REITs) will.

WarnerMedia Studios and Networks Group CEO Ann Sarnoff calls this is a short-term plan. The Hollywood Reporter piece that broke the news quoted her as saying:

"With this unique one-year plan, we can support our partners in exhibition with a steady pipeline of world-class films, while also giving moviegoers who may not have access to theaters or aren’t quite ready to go back to the movies the chance to see our amazing 2021 films. We see it as a win-win for film lovers and exhibitors, and we’re extremely grateful to our filmmaking partners for working with us on this innovative response to these circumstances.”

That’s nice. But once the cat is out of the bag, it's very difficult to put it back in. If this direct-to-consumer, high-margin plan works for AT&T, we see little reason why it won’t catch on from there.

In which case, consider this yet another example of how COVID-19 is changing the way companies do business. We suppose it’s only left to see how permanent those changes will be.

(Source)

Big Changes Coming to Content Distribution

Some may see the Warner Bros. news and think, "Big deal. Disney (DIS) rules the box office these days. I’ll act accordingly when it starts moving."

That's true. Disney has dominated in recent years, thanks to Marvel movies and Star Wars

Your One Stop Shop For “Everything Income”

Don’t forget that iREIT on Alpha is committed to helping investors make the most of the good times and navigate the turbulent times too. Our coverage spectrum includes equity REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and, more...2 Week FREE TRIAL plus my FREE book.

Don't miss dozens of C-suite interviews on my "Ground Up" podcast. Especially not when I just posted perhaps the mother of all corporate chit-chats the other day.