Article Thesis

New Residential (NRZ) had seen the pandemic ravage its old business model, which has also taken down its shares quite a lot. The company has adapted, however, and is generating strong profits through its operating businesses now. Shares have risen considerably over the last couple of months, and the dividend has been raised for two quarters in a row. Another dividend increase does not seem unlikely, but following steep gains for shares, we are moving to a more neutral rating for now.

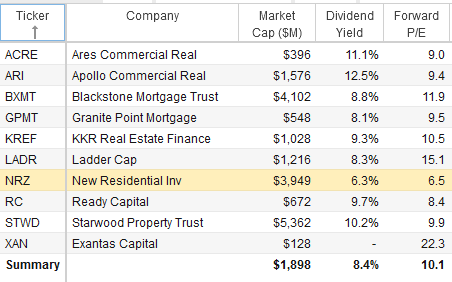

Source: StockRover.com

In the above table, we see a comparison between New Residential and several other mREITs. New Residential trades at one of the lowest valuations in its peer group, although its dividend yield is not especially high versus other mREITs. The combination of a high earnings yield and a somewhat lowish dividend yield (compared to peers) results in strong dividend coverage for this REIT, however, which means that dividend growth potential is stronger than with most of its peers.

New Business Model Offers Solid Earnings Power

A couple of years ago, New Residential generated the vast majority of its profits through its portfolio that included a range of assets such as (excess) mortgage servicing rights, advances, but also things like credit card debt, etc. Before the current crisis, management decided to move the company towards a different business model, one that is also incorporating operating businesses such as mortgage originations. That was, in retrospect, a great idea, as the pandemic and the pandemic-induced market crash in March ravaged New Residential's portfolio. The REIT sold a large amount of assets, partially below book value, as did many peers. Unlike many peers, however, New Residential did not see its profits fall off a cliff, as its operating businesses have generated strong profits this year.

This is not

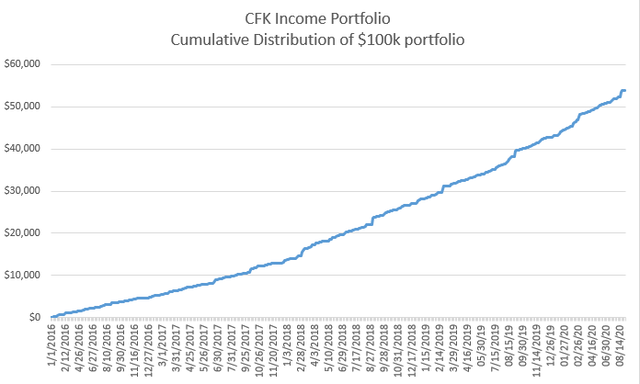

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7-10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, the income stream not so much. Start your free two-week trial today!