Unless you have been living under a rock, you would have noticed the remarkable rally in technology stocks. The data center REITs were also one of the key beneficiaries of this trend. We saw this at the beginning of the year as the S&P 500 (SPY) faltered, while the key players in this space outperformed.

But something changed late in the year. While technology indices continued to hit new highs, the 3 data center REITs delivered a rather poor performance.

We examine one today and see if we can make an investment case for it.

Digital Realty Trust Inc. (NYSE:DLR)

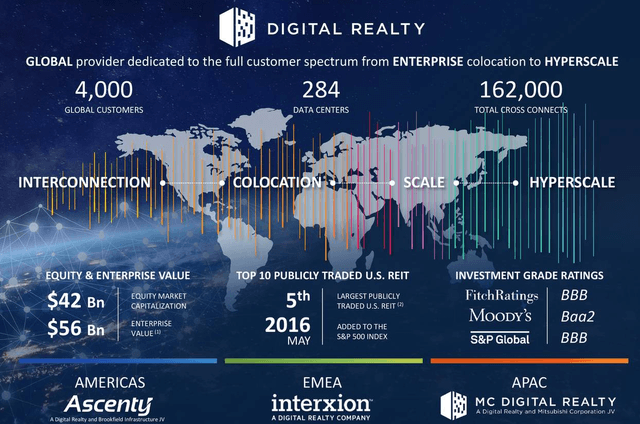

DLR is one of the largest publicly-traded REITs and has built a ginormous scale in the Data Center platform.

Source: DLR presentation

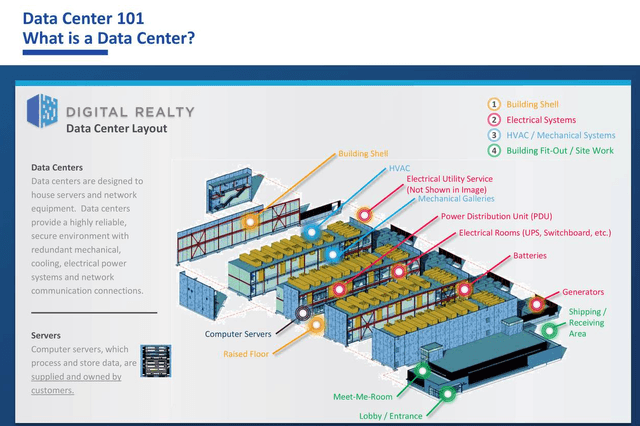

The company is happy to provide you with some basic education as well, in case you did not know what a data center actually was.

Source: DLR presentation

The fundamental case for data centers simply comes from the ever-expanding need for data storage and the ever-expanding use of technology (which feeds into more data storage). DLR has certainly richly rewarded investors over time for their investment.

The Other Side Of The Trade

While you don't have to look very far for a radically bullish case, we want to tell you today why we are staying out despite the decline in this stock. The first and primary reason is that growth rates are radically slower than what DLR would have you believe.

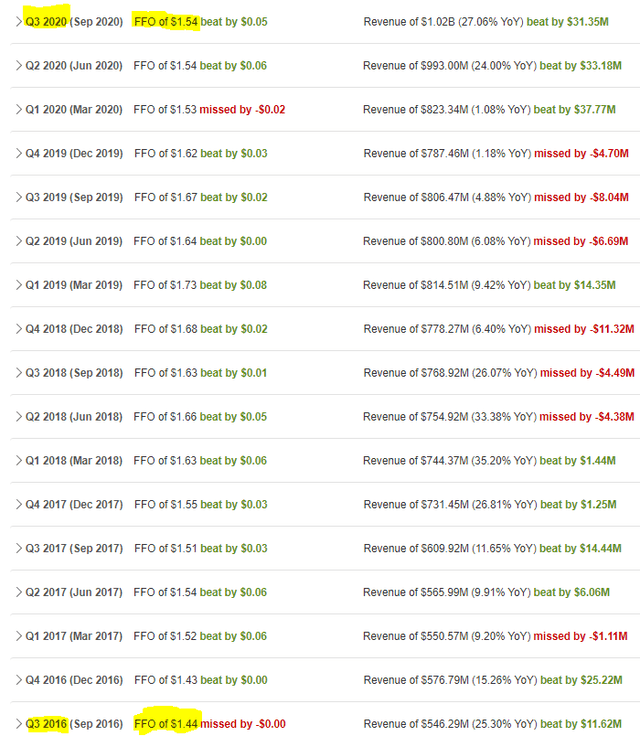

Source: Seeking Alpha

Over the last four years, DLR has grown funds from operations (FFO) per share by exactly 10 cents or 6.9%. That works out to around 1.6% a year compounded. Pretty much most utilities we follow have grown faster than that. What is rather phenomenal about this is that DLR has managed such a radically slow growth rate despite multiple tailwinds.

Are you looking for Real Yields that reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best-priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.