Since my last article on FLIR Systems, Inc. (FLIR) in August, the stock has gained about 15%, validating some of the points I referred to in that article. Since that time, we've had the company release its Q3 earnings, and the nation has gone through one of the most closely contested Presidential elections in recent times. There are several implications for the company based on these two events that I'd like to cover in this piece.

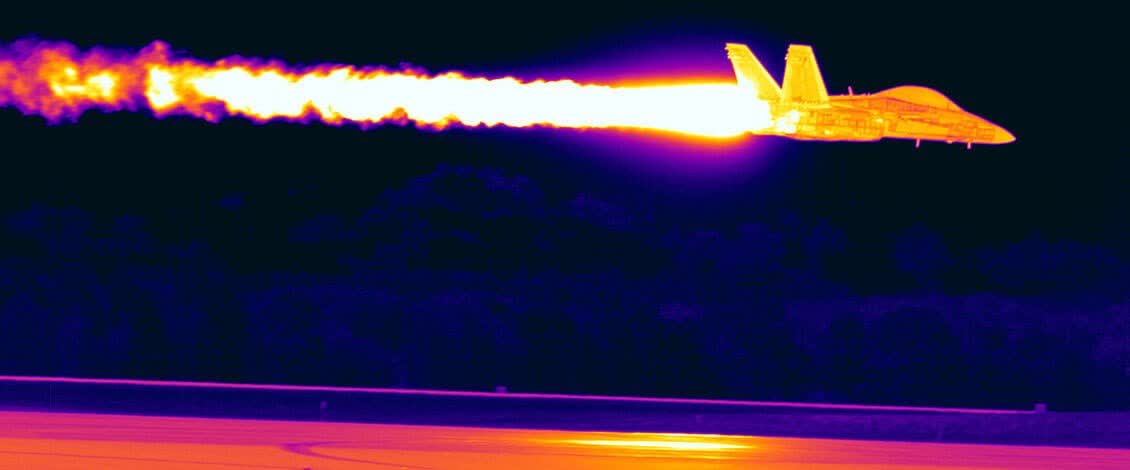

Source: FLIR.ca

Quick Overview and Highlights of FLIR's Q3 Earnings

The overall revenue decline of 1% was marginal and missed the estimate by $2.6 million. Due to the Project Be Ready cost savings drive, the company was able to deliver an adjusted EPS of $0.64, beating the estimate by $0.10. The beat allowed the stock to rally nearly 10% after the earnings announcement. However, the stock dropped again after Election Day and has been going on a virtual roller-coaster ride as it steadily climbed to the as-of-writing price of around $41.

As predicted, the sales of EST (elevated skin temperature) equipment boosted the top line again this quarter, but the security business is still showing signs of weakness. As I noted in my last article, FLIR Systems: What the Market is Missing, problems on the commercial side of the company's revenue streams have been around since before Q4-19. We saw that headwind continue in Q3-20, per management's prepared remarks at the Q3-20 earnings call:

These revenue contributions were offset by lower volumes in commercial end markets in our Industrial Technologies segment due to COVID-19 and timing of certain contracts that contributed to revenue in the prior year quarter in our Defense Technologies segment.

While commercial did contribute to some of the declines in the Industrial Technologies segment, the bulk of it has come from the