Infineon (OTCQX:IFNNY) recently organized a joint session for its Industrial Power Control (IPC) and Power & Sensor (PSS) divisions (c. 14% and 29% of fiscal 2020 group sales, respectively) as part of its power semiconductor roadshow. The call reaffirmed both the near-term and longer-term outlook across segments, with some end markets even tracking better than expected. Furthermore, Cypress (CY) synergies are being realized ahead of schedule, which is encouraging. Along with these earnings tailwinds, accelerating electric vehicle demand should also continue to support valuations. At the current c. 15x EV/EBITDA multiple, Infineon shares trade at a discount to closest peer NXP Semiconductor's (NXPI) c. 18x EBITDA multiple, leaving plenty of room for further upside.

IPC Division to Benefit from the Renewables Growth Story

For the IPC segment, management continues to see healthy broad-based growth for the upcoming year, which is positive. Considering its broad customer base across the major players for PV inverters and wind turbines, Infineon is in prime position to benefit from the projected c. 10% CAGR in this market over the medium-term, in addition to the robust growth outlook in 2021. Similarly, the Industrial Drives business, which contributed c. 30% of sales in fiscal 2020, is also primed for recovery following continuous declines in recent years.

Source: Infineon Roadshow Presentation Slides

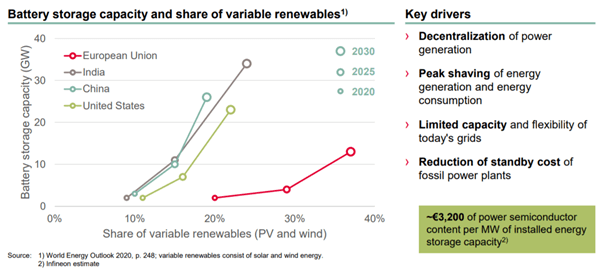

Also worth noting is that as more energy comes from renewables (which has a less stable supply), additional market opportunities emerge in the batteries space, in-line with buffer energy storage requirements. The growth in buffer battery storage is projected to be led by North America, while China and India should also be growth engines. By contrast, Europe is projected to lag, which makes sense considering it already benefits from the presence of a well-connected power grid.

Source: Infineon Roadshow Presentation Slides