The single-family property asset class is a relative newcomer to the REIT space and is a fast-growing one. In this article, I’m focused on American Homes 4 Rent (NYSE:AMH), which has demonstrated impressive growth since its IPO in 2013. The shares have also been rather resilient this year, posting a 15% return since the start of the year. I evaluate whether if AMH is an attractive buy at the current valuation, so let’s get started.

(Source: Company website)

A Look Into American Homes 4 Rent

American Homes 4 Rent is a leading internally-managed REIT that is focused on owning and acquiring single-family homes. As of September 30, 2020, AMH owns 53,229 single family homes that are geographically diversified across 35 markets in 22 states in the Southeast, Midwest, South, and Western regions of the U.S. In 2019, AMH generated $1.17B in total revenue.

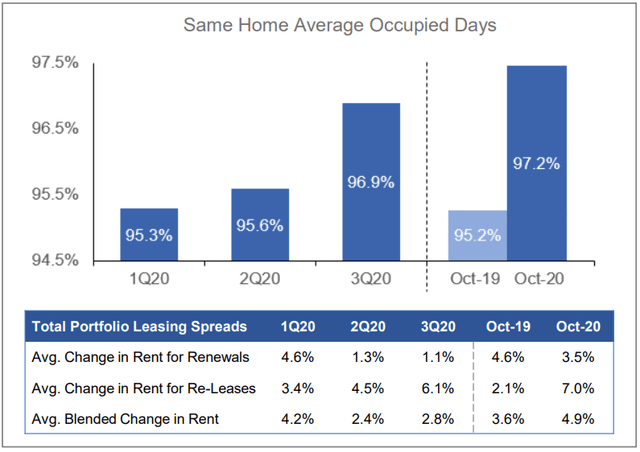

AMH continues to do well in the current environment, with revenue increasing by 4.2% YoY, from $298M in Q3’19, to $311M in Q3’20. It also grew its Core FFO/share by 3.6% YoY, from $0.28 to $0.29 in the latest quarter. Core NOI growth on same-home properties also grew by 4.0% YoY, and the portfolio is seeing record demand, with 96.9% occupancy, and a 5.9% rental growth rate on new leases, which compares favorably to the 1.2% rate of inflation over the past 12 months.

I see the positive momentum carrying into the current quarter, Q4’20. This is supported by continued occupancy gains in October, which, as seen below, improved to an impressive 97.2%. Plus, as another sign of continued strong demand, the blended increase on new rents (on renewals and re-leases) improved 130 basis points, from 3.6% in October 2019, to 4.9% in October of this year.

(Source: November Investor Presentation)

I also see AMH as benefiting