By Jharonne Martis

Perhaps the biggest retail trend in 2020 was the accelerated shift Americans made to online shopping, driven by the COVID-19 pandemic.

This trend will be a big contributor to the economy in 2021 as e-commerce continues to grow as a percentage of total retail sales. Note that e-commerce transactions accounted for 14.3% of retail sales as of Q3 2020, compared to 4.2%

The survey also shows that the number one holiday gift is gift cards for both Americans and Canadians. This means there will likely be a delay in purchases, and the reporting of sales/revenue until these gift cards are redeemed. Consumers might receive these cards as gifts, and then just carrying them in their wallets for many months, even if they are Visa cards for "emergency cash." This means the market could potentially be deprived of immediate infusion.

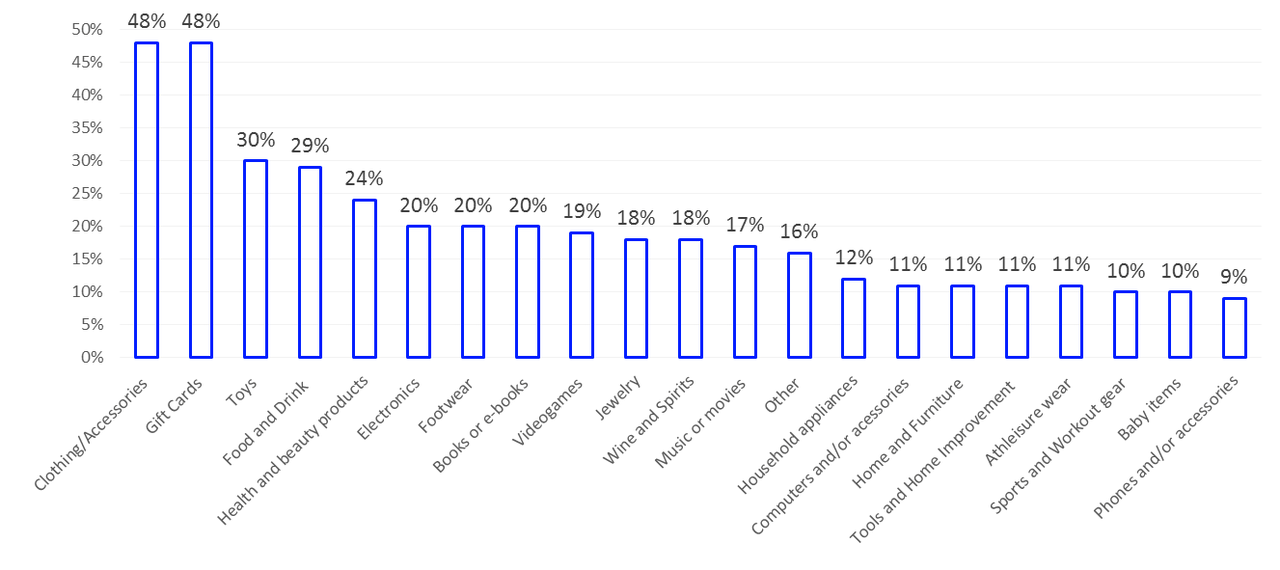

Of all the gifts they have either already purchased or intend to do for others, the following are the categories they will be gifting during this 2020 holiday season:

Exhibit 2: Items U.S. Consumers are Looking to Purchase this Holiday 2020

Source: Maru/Blue Public Opinion Survey

Which consumer stocks are setting up for big moves?

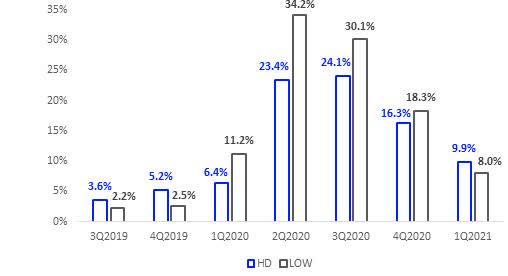

Home Improvement

As another wave of COVID-19 looms, consumers continue to improve the stay-at-home experience. Home Depot (HD) and Lowe's (LOW) posted impressive e-commerce sales in Q3 2020. The same can be said for the holiday same-store sales, which are projected to continue to grow in 2021. This is mainly because there has been an uptick in DIY projects. Consumers are at home, fixing and improving their households.

Exhibit 3: Home Improvement Same-Store Sales 2019-2021

Source: I/B/E/S data from Refinitiv

Home Furnishing

This is another sector benefiting from the nesting trend. Lovesac (LOVE), Williams-Sonoma (WSM), Restoration Hardware (