Introduction

Three months have gone by since the previous edition of the Nest Egg Portfolio so it’s about time for a closer look at the portfolio and update it with a few recent transactions while also removing the options from the portfolio past their expiry date.

In the previous edition of the Nest Egg Portfolio, Orange Belgium (OTC:MBSRF) (OTC:MBSRY) was added back to the portfolio. Unfortunately (or, rather, fortunately) we sold the stock again in December after parent company Orange (ORAN) made a run to acquire all outstanding shares of Orange Belgium it didn’t already own. Apparently Orange shared our thesis Orange Belgium was undervalued, but unfortunately our profits are minimal as we hadn’t established a full position yet. You can re-read our previous Nest Egg Portfolio about Orange Belgium here.

In this edition, we’re looking back at Red Electrica (OTC:RDEIF) (OTCPK:RDEIY), the Spanish power transmission operator. Back in 2017, the company promised an increasing dividend, and although it has indeed continued to pay dividends, the share price hasn’t moved. Time for a check-up.

Red Electrica de Espana: time for an update

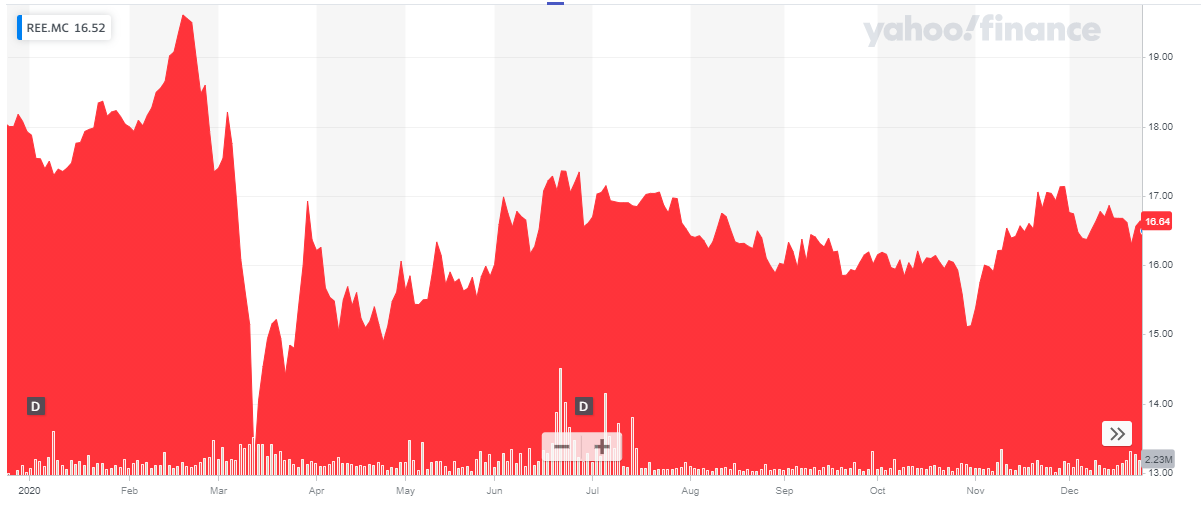

Red Electrica has a very liquid listing on the Madrid Stock Exchange, where it’s trading with REE as its ticker symbol. With an average daily volume exceeding 1.4 million shares, the Spanish listing offers superior liquidity.

Source: Yahoo Finance

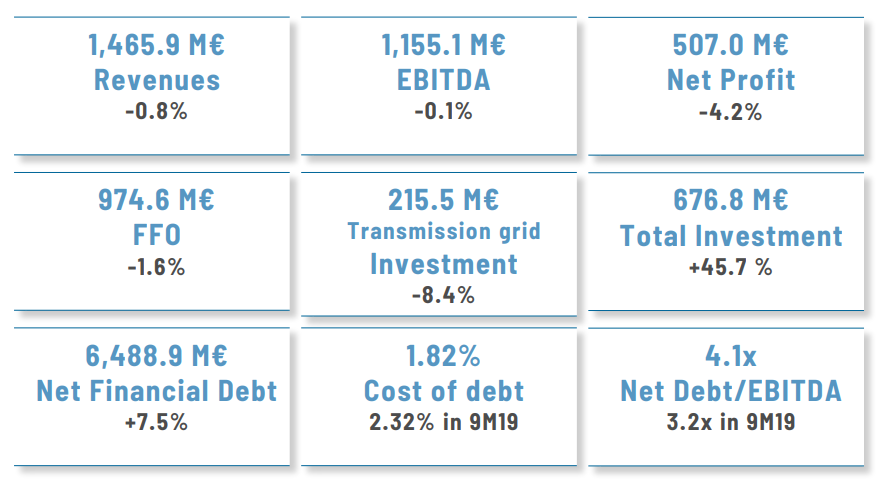

In its 9M 2020 announcement, Red Electrica provided a nice overview of how the renewable energy sector in Spain gained a lot of importance this year. About 61% of Spanish electricity production is now emission free, and Red Electrica will continue to invest in assets that simplify the transmission of "green" energy throughout Spain.

Source: company presentation

Although the demand for electricity fell by about 6.6% in Spain, Red Electrica was able to keep the impact on its revenue limited as

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!