This paper covers PaySign’s business operations under a long term perspective. It also reviews 3Q20 performance, financially, and through the lens of current business activity, which ought to drive financial progress. The conclusion distills the substance in these perspectives; Why PaySign is a very good company.

Background

PaySign, Inc. (NASDAQ: NASDAQ:PAYS) is a provider of prepaid card programs, payment processing and digital banking services. The PaySign brand offers card products for, healthcare reimbursement payments, donor compensation, pharmaceutical co-pay assistance, corporate incentive rewards and corporate expense, per diem and travel payments. Plasma donation and pharma affordability are the two principal businesses.

In the plasma donation industry prepaid card payments are designed to reward plasma donors. Plasma collectors, who collect plasma from donors, are PaySign’s clients. In pharma the prepaid cards offset out-of-pocket expenses of patients who purchase prescriptions from the pharmaceutical companies, PaySign clients. As a payment processor and prepaid card program manager, the company derives revenue from all stages of the prepaid card lifecycle.

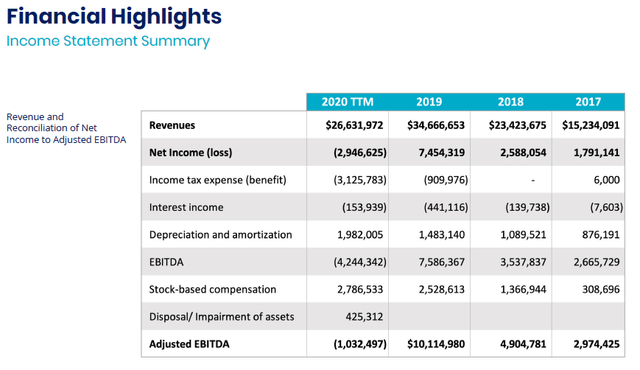

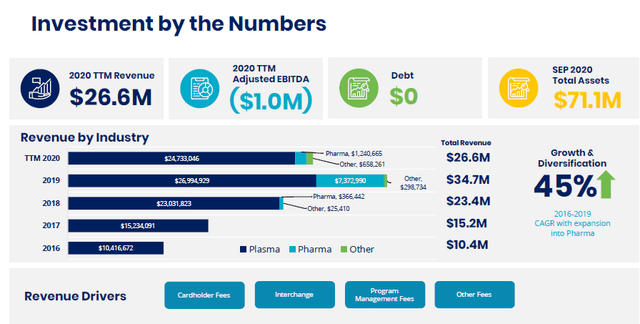

(All the charts presented in this article are from PaySign Investor Presentation, November 2020, unless otherwise shown).

Plasma has been the mainstay of the company and the engine behind historical growth; the first client was enrolled in 2011. Since that time, growth has been remarkable. In 2019 Pharma became an important revenue contributor; revenues were $7.4 million, or 21% of total revenues ($34.7 million), growing from $367 thousand in 2018.

Plasma donors are generally paid $40-$50 per donation and are permitted two donations per week. They are compensated for donations by means of prepaid cards. A large portion of donors, who do not have checking accounts, find prepaid cards to be a preferable alternative to cash. Low-income families represent a significant portion of the donor population. They rely on donation income as an important supplement to the household budget.