Over the last few years, there haven't been a plethora of quality silver miners to buy. But a company has just emerged that I feel can be added to the shortlist.

Gatos Silver (GATO) just went public in November 2020, and since then, it has gained over 40%. I highlighted the stock for The Gold Edge subscribers just a few weeks after it IPOed, as the story is extremely compelling, especially considering the valuation. Despite the increase in market cap since then, GATO has plenty of upside potential. Below are all of the reasons that make GATO such an intriguing silver stock.

1. Cerro Los Gatos Is Fully Built And Reached Commercial Production in 2019

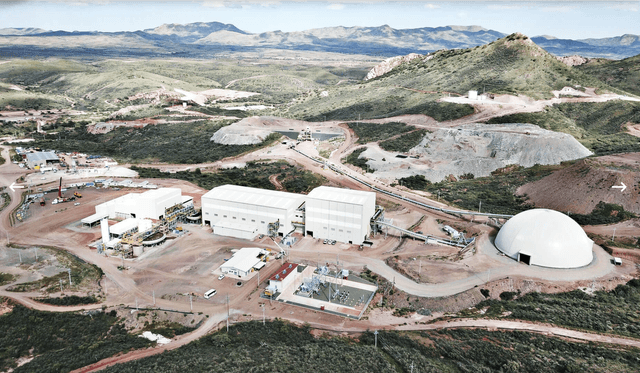

Gatos Silver has a JV on the Cerro Los Gatos (CLG) silver-zinc-lead-gold mine in Mexico. With its JV partner Dowa Metals and Mining (a Japanese company), Gatos constructed the $316 million mine, and it was completed on time and budget. In 2019, the mine reached commercial production but took a step backward this year due to COVID-19 (more on this in a bit).

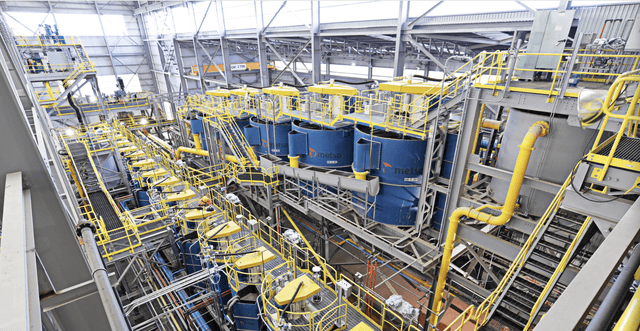

Below are some of the pictures of the asset, which highlight the size and quality of the infrastructure. It's rare to come across a mining stock that is brand new to the market and has a fully constructed project. Most times, investors have to wait years before they will see a project begin to bear fruit. And the risk of dilution along the way — to finance the asset — is one of the main downsides for developers and why their stock prices tend to underperform during the construction phase. With Gatos, there are none of those risks.

(Source: Gatos Silver)

(Source: Gatos Silver)

2. One Of The Largest And Highest-grade Producing Silver Mines In North America, With Reserves At 641 g/t AgEq

Subscribe To The Gold Edge

The opportunity in this sector is here, but to succeed, you need a deep knowledge of gold and the miners. The Gold Edge is my premium, research-intensive service that provides that knowledge as I'm sharing all of my thoughts, ideas, and research on the gold sector. If you would like access to all of my analyses, including my top gold and silver mining picks, subscribe to The Gold Edge. Click here for details.