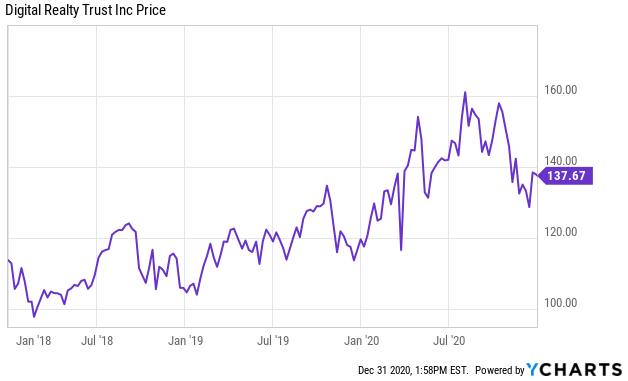

Digital Realty (NYSE:DLR) is an attractive data center REIT for investors seeking steady income and long-term capital appreciation. It has raised its dividend for the past 15 years (it currently yields 3.2%) and is likely to keep increasing it considering strong industry tailwinds. In our view, there is a disconnect between healthy business fundamentals and recent share price performance (the shares are down in the last 2-months). This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion on investing.

Overview:

If you don't know, Digital Realty is a leading data center REIT (it owns, acquires, develops and operates data centers). DLR covers the entire spectrum from colocation to enterprise to hyperscale data centers. The company's portfolio consists of 284 data centers, including 43 data centers held as investments in unconsolidated joint ventures. Of these, 147 are located in the US, 41 in Europe, 19 in Latin America, 10 in Asia, five in Australia and three in Canada.

DLR is well diversified geographically. North America is its largest market accounting for 62% of its total operating revenue as of 3Q20. This is followed by EMEA at 30%, APAC at 6% and Latin America at 2%.

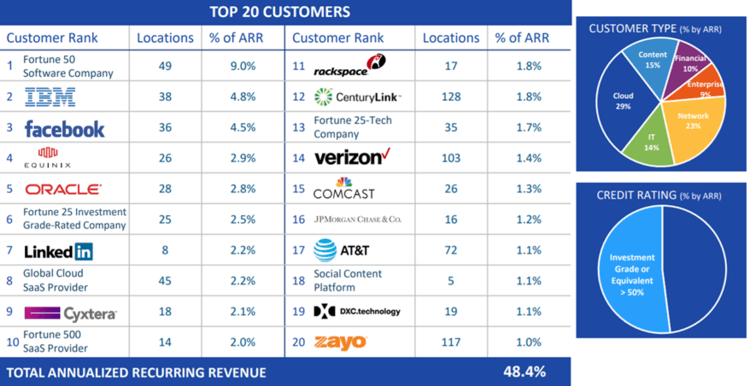

Moreover, Digital Realty has a high quality and diversified customer base across industries ranging from cloud and information technology services, communications and social networking to financial services, manufacturing, energy, gaming, life sciences and consumer products. The top 20 customers account for just 48.4% of total rent with no single customer accounting for more than 9.0% of rent. More than 50% of its clients have investment grade or equivalent credit ratings. Overall, as you can see in the graphic below, DLR has a very strong group of customers.

Digital Realty continues to expand its global presence which positions it well

Top REIT Idea: Because of its attractive qualities, we have ranked Digital Realty #9 on our newly-released members-only report: Top 10 Big-Dividend REITs (we'd have ranked it higher if the yield was higher).

And if you are interested, we are currently running a complimentary 2-week trial of our service (Big Dividends PLUS) as part of our New Year's Sale. Hurry because the offer expires soon.