Taiwan Semiconductor Manufacturing (NYSE:TSM) is a leading multinational semiconductor contract manufacturing and design company. The company has a market cap near $500 billion, but that's minimal in relation to the next wave of technology. Fundamentally, the company manufacturers chips for customers using 300 mm wafers at a variety of sizes, on the forefront of foundry technology.

As we'll see throughout the article, the company's continued record investment (~$20 billion in 2021 capital expenditures) combined with its market leading position should drive long-term profits.

Taiwan Semiconductor Manufacturing Volume Growth

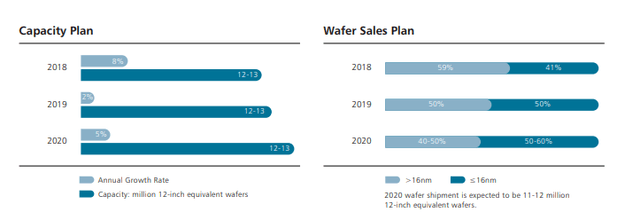

Taiwan Semiconductor Manufacturing is focused on consistently growing its asset base with the aim to provide higher volumes to shareholders.

Taiwan Semiconductor Manufacturing Capacity - Taiwan Semiconductor Manufacturing Annual Report

Taiwan Semiconductor Manufacturing fundamentally manufactures wafers along with the chips for those wafers. The baseload of the company's abilities is not only the capacities at which it can manufacture those wafers (10 nm, 7 nm, etc.) but also the number of wafers it is actually capable of manufacturing and selling.

The company in 2018 manufactured 12-13 million 12-inch equivalent wafers. In 2018 its annual growth rate was 8%. In 2019 it was 2% and in 2020 it was 5%. The company has had steady mid-single digit capacity growth here. At the same time, the company has steadily moved to smaller wafers. In 2018, the company sold 41% <16 nm wafers. By 2020 it's expected to be ~55%.

That's expected to continue in subsequent years. It's not surprising with massive demand, Apple has already secured 80% of Taiwan Semiconductor Manufacturing's 2021 5 nm production.

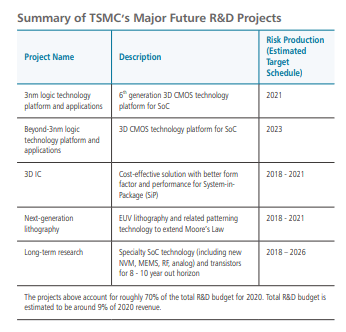

Taiwan Semiconductor Manufacturing Low NM Growth and Leadership

Taiwan Semiconductor Manufacturing's major source of leadership is the company's low NM growth and leadership.

Taiwan Semiconductor is a leader in manufacturing. The company has hit 5

Create a High Yield Energy Portfolio - 2 Week Free Trial!

The Energy Forum can help you generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing and you can be a part of this exciting trend.

Also read about our newly launched "Income Portfolio", a non sector specific income portfolio.

The Energy Forum provides:

- Managed model portfolios to generate high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic market overviews.