The iShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG) is a fund that will take advantage of current economic conditions to give investors returns that will beat the U.S. market. IEMG presents investors with exposure to a group of over 2,500 emerging market (EM) stocks. The emerging markets have gained increased positive sentiment recently and this has propelled the ETF to new highs. This momentum has been a direct result of optimism surrounding the economic recoveries of EM. When considering this investment, I took a global macro approach. Taking into account a weakening U.S. dollar, rallying commodity prices, and strong economic growth, emerging markets will be an outperformer over the next few years. I believe that IEMG is the top EM fund considering its high quality.

The Fund

IEMG is a fund that tracks the MSCI Emerging Markets Investable Market Index, composed of large-, mid-, and small-cap EM equities. It currently has $70.2 billion in assets and contains 2,501 holdings. The fund specifically places a focus on Asia. This segment is particularly attractive for investors because these countries are projected to benefit from economic growth more than other developed countries.

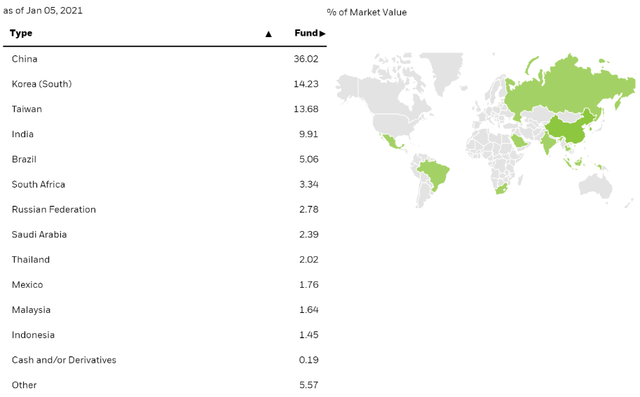

IEMG has 36% of its assets in Chinese equities, 14.2% in South Korea, and 13.7% in Taiwan. Most of the fund is based in Asia, which could be a room for improvement for the fund. More geographic diversification could prove to be beneficial, especially considering Russia (2.78%) and Brazil (5.06%) represent smaller exposures. The fund's exposure to South Korea is important when screening for EM ETFs, because other funds like the Vanguard FTSE Emerging Markets ETF (VWO) do not include South Korea in the fund. I believe that South Korea is a key differentiator for IEMG that gives investors a benefit over these other ETFs, which I will cover later.

(Source: