Michael Jordan-backed, plain white t-shirt icon Hanesbrands (NYSE:HBI) has been a bit of a battleground stock in the past couple of years. The company has been trying to engineer a turnaround, and to an extent, it has worked. COVID-19 obviously put a damper on things in a big way for the company in 2020, and I was bullish back in the summer of 2020 on rebound potential.

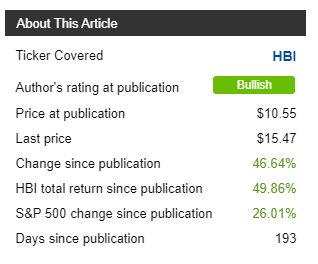

It's been a bit over six months since that call and the stock has returned about 50%; that ain't bad, as they say. That's double the S&P 500's return over the same period, and it's a huge return on an absolute basis, so how am I feeling about HBI now?

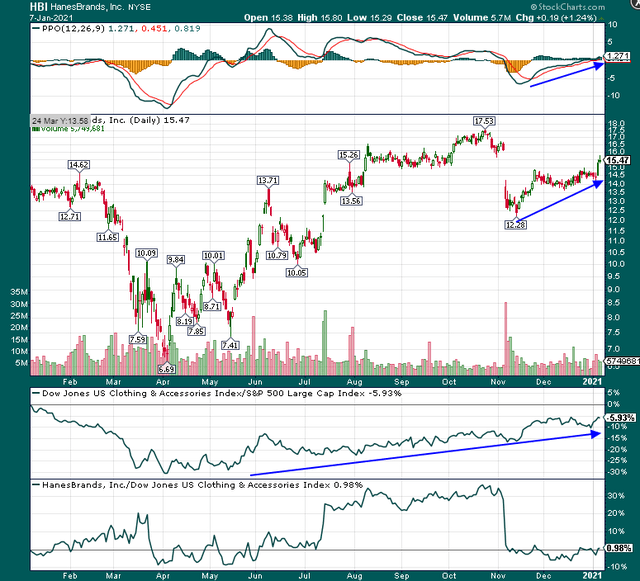

I see some signs of bullishness in the chart, which I've highlighted with arrows. Momentum has been steadily improving since the whacking the shares took in early November, so that's +1 for the bulls. The index the company is part of - clothing and accessories - continues to outperform the broader market, so that's another point for the bulls. HBI isn't outperforming the peer index, but it is keeping pace, so let's call that a draw.

So while I see some encouraging signs on the chart, I also see gap resistance around $16 where HBI fell from in early November that the bulls will have to contend with. That isn't always easy, and I don't necessarily see a catalyst for a move through $16. Indeed, as we'll see below, fundamental factors have me moving from bullish to neutral on HBI, and I'll actually be quite surprised if HBI moves through $16 anytime soon.

A turnaround that is now priced in

To put it succinctly, my biggest worry about HBI now is not that it cannot continue to slowly mend