Cboe Global Markets (BATS:CBOE) is a financial marketplace offering trading capabilities including options, foreign exchange, futures, U.S. and European equities and various volatility products. The CBOE Volatility Index, VIX, is the most commonly referenced product in regards to volatility of the domestic equity market.

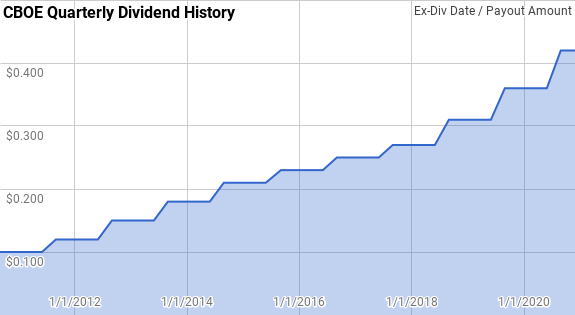

Dividend History

The investment strategy that I gravitated towards most when I began investing on my own was dividend growth investing. In practice, dividend growth investing is about identifying companies that are built to last and that have a management team that is willing to share cash flow via dividends. It's akin to the aphorism of "a bird in the hand is worth two in the bush" with a preference of receiving some of my returns now as opposed to an implied promise to receive them in the future.

Image by author; data source Cboe Global Markets Investor Relations

Image by author; data source Cboe Global Markets Investor Relations

CBOE is a Dividend Contender with 11 consecutive years of dividend growth. CBOE initiated its dividend back in 2010 and has raised it every year since, including coming out of the worst of the COVID-19 crisis from early 2020.

Over the 11-year streak, CBOE's year-over-year dividend growth has ranged from 8.3% to 22.7% with an average of 14.7% and a median of 14.2%.

There's been 8 rolling 3-year periods during CBOE's dividend growth streak with annualized dividend growth ranging from 9.7% to 21.0% with an average of 14.5% and a median of 13.9%.

The 1-, 3-, 5- and 10-year rolling period annualized dividend growth rates from CBOE since 2010 can be found in the following table.

| Year | Annual Dividend | 1 Year | 3 Year | 5 Year | 10 Year |

| 2010* | $0.40 | ||||

| 2011 | $0.44 | 10.00% | |||

| 2012 | $0.54 | 22.73% | |||

| 2013 | $0.66 | 22.22% | 18.17% | ||

| 2014 | $0.78 | 18.18% | 21.03% | ||

| 2015 | $0.88 | 12.82% | 17.68% | 17.08% |