Sumo Logic (SUMO) reported impressive results last quarter. The Street appears uncertain about some elements in the growth story. On the contrary, Sumo Logic appears to have a firm grasp of its growth narrative. I find the valuation compelling due to its unique positioning.

Demand

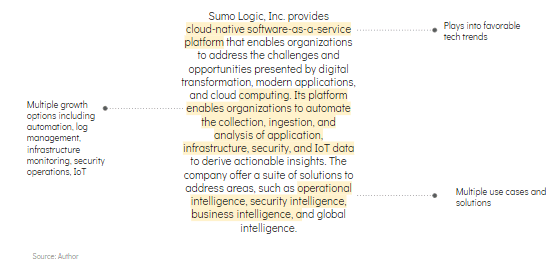

Sumo Logic provides a SaaS-based continuous intelligence platform that plays into the DevSecOps trend. The DevSecOps trend includes Observability, SecOps, and ITOps offerings.

Source: Sumo Logic

Last quarter, the market's reaction to earnings was mixed. Revenue growth was 28% while calculated trailing twelve months billings was 21%. Sumo Logic highlighted a mix of favorable and unfavorable macro trends. I believe the unfavorable macro trends are temporary. The macro headwinds include its 10% ARR exposure to COVID impacted verticals, small business churn driving weak DBNER (dollar-based net expansion rate), extended payment terms, and budget scrutiny.

Despite the headwinds, Sumo Logic highlighted solid RPO (remaining performance obligation) growth of 51%. This is a significant improvement compared to the previous quarter. The improved RPO signifies a strong commitment from new and existing customers. It is important to stress this fact for investors focused on billings. Billings is a metric that is more impacted by seasonality and the timing of renewals.

Going forward, Sumo Logic provided revenue growth guidance of 17%-18% in Q4'21. This implies FY'21 revenue growth guidance of 29% to 30%. The guidance isn't the most attractive relative to the momentum of peers (Datadog (DDOG), Elastic (ESTC)) in the DevSecOps space. Regardless, the evolving sales and product strategy, in addition to favorable macro trends, drive my conviction in the growth story.

Business

Last quarter, Sumo Logic reiterated its blend of direct sales and partner-led sales motion. As a cloud platform, Sumo Logic benefits from strong integration and partnerships with system integrators driving digital transformation initiatives. It also benefits from cloud service