Insurers have been well out of favor with investors in the past year as growth has trumped value in terms of allocation. Insurers, of course, are typically value plays and don’t exhibit a lot of growth, so their share prices suffered. The good news is that their value propositions in a lot of cases have improved, even with the recent rally we’ve seen. One such example is Allstate (NYSE:ALL).

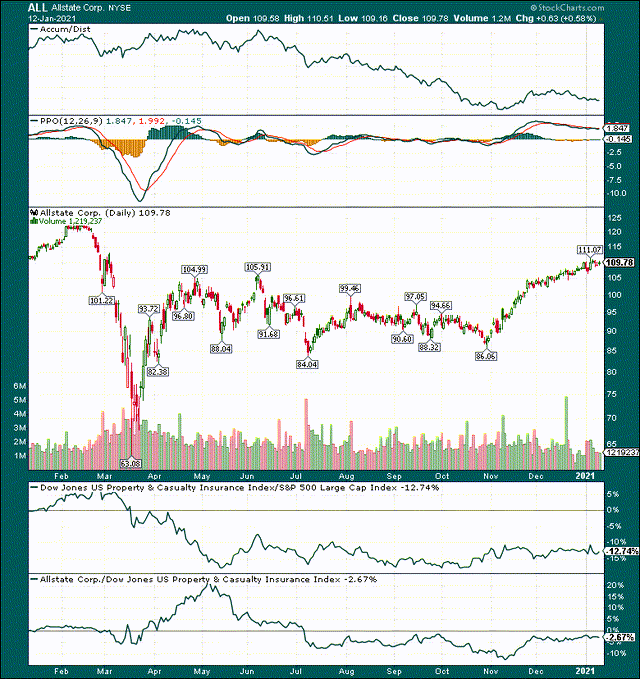

We can see a very sharp rally since late October, when shares bottomed at $86 and never looked back. The stock still isn’t at pre-COVID levels, and I still see it as representing value – more on that in a bit – but I do have a couple of notes of caution short-term when you’re looking at your entry point.

In the top panel, we have the accumulation/distribution line, which is one way to measure participation in a rally. The A/D line has moved consistently lower over the past year, so that tells me institutional money isn’t necessarily buying the rally.

Similarly, the PPO in the second panel is showing a negative divergence on the daily chart, having topped out in November and trending lower since despite new highs in the share price. These are not guarantees but on balance, they suggest to me at least some consolidation is necessary in the share price, or perhaps a small pullback. This doesn’t change my bullishness long-term, but I don’t think there is any need to rush out and buy Allstate today, either.

Pandemic? What pandemic?

Allstate has performed exceptionally well considering the conditions that have prevailed for most businesses in the past year. Allstate is seeing a minor bump in the road in terms of top line growth, but as we can see below, there isn’t much to mention in terms of disruption.