As the economy gets back to normal, financials like Ally Financial (NYSE:ALLY) are returning to substantial capital returns. Unfortunately, the stock is already up to all-time highs. As the auto finance sector survived the virus crisis far better than originally predicted, my investment thesis remains bullish on the stock here with the boosts from capital returns.

Image Source: Ally Financial website

Capital Returns Return

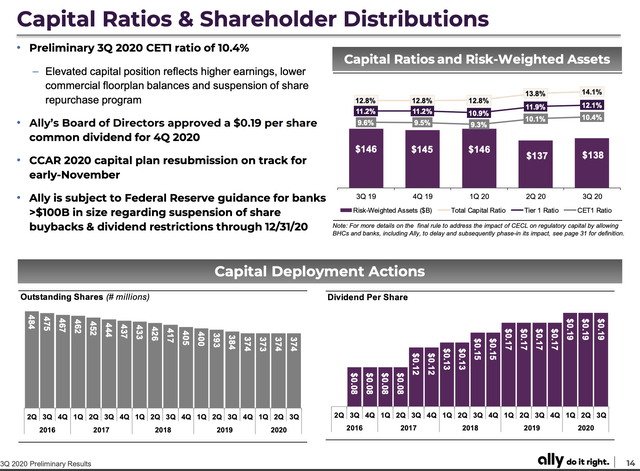

Due to the economic weakness from COVID-19 lockdowns, the Fed required the large financials with $100 billion in assets to suspend stock buybacks through 12/31. Ally was an aggressive stock repurchaser over the last few years until buybacks were pulled on March 17.

As the financial says in the press release announcing the up to $1.6 billion stock buyback for 2021, the results of the Federal Reserve Board stress test in December authorized Ally to return to share buybacks. The only restriction is that capital returns can't exceed average trailing four quarter net income.

The company was able to maintain the quarterly dividend at $0.19 throughout the crisis. Ally raised the dividend last January from $0.17 for an 11.8% dividend hike right before the crisis started.

Source: Ally Financial Q3'20 presentation

With capital ratios above 2019 levels, Ally has plenty of capital for aggressive capital returns. The CET1 ratio sat at 10.4% after Q3 compared to only 9.6% last Q3.

The dividend yield currently sits around 2.5% and when combined with the stock buybacks will offer a rather solid net payout yield. The net payout yield combines the dividend yield and the net stock buyback yield to offer a better yield to derive whether a stock is cheap. The net payout yield would top 13% despite the stock trading at highs here.

Of course, the biggest weakness in stock buybacks and net payout yields is that financials

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to double and triple in the next few years without taking on the risk of over priced tech stocks.