Written by Sam Kovacs

Introduction

The year 2020 was wild. The world stopped, markets went down then all the way back up, a pandemic spread, then a vaccine was found, then another, and another, but then a variant threatened it all.

But now we're already two weeks into 2021.

Last year, we realized that simply analyzing stocks and suggesting when something was a buy or a sell, wasn't quite cutting it for us.

It failed to include many of the insights which come with our somewhat unique approach to investing, namely position sizing, when to buy vs when to sell, and the general philosophy and how to tailor it to your needs.

In this article, I will attempt to synthesize what I believe are the two biggest threats of 2021, and offer our "cure".

The two biggest threats of 2021

The two threats of 2021 come from two sources. The first is the lofty prices that we are seeing throughout the market seem unsustainable.

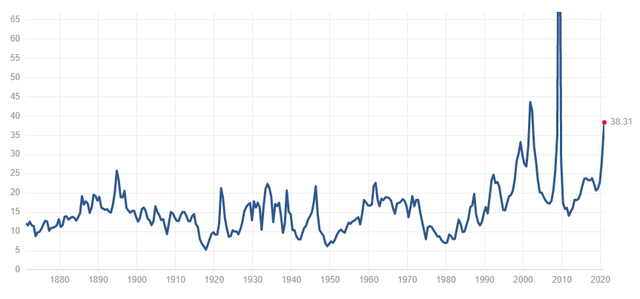

Take the S&P 500 (SPY). It is currently trading at 38x earnings, more than double its historical median. This is worrying.

Source: Multpl

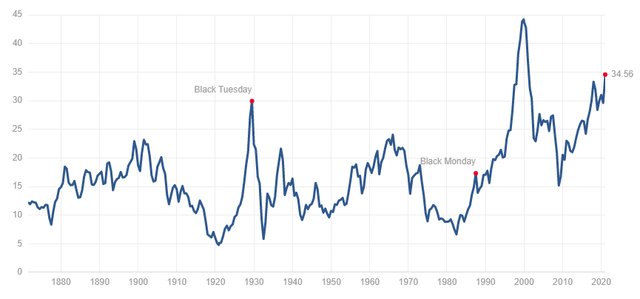

Sure, earnings are seasonal, which is why economist Robert Shiller offered a version which uses 10 year average earnings rather than TTM earnings, when computing the PE.

The multiple is currently known as the Shiller PE, and is a good indicator of market prices.

Source: Multpl

Well, here is the news: in recorded history, only one cycle saw more extreme numbers: the dotcom bubble.

As you'll see in our "cure" to these threats, overpaying is always dangerous.

If you wanted to buy a new car, what do you think your chances of selling it without a loss were if:

- a. the dealer gave you a 50% discount. Or,

- b. the dealer

Need Help in 2021? Follow us for more.

Did you enjoy this article? Then click on the orange "follow" button at the top of the page to be notified the next time we publish an article on dividend investing.

Did you enjoy this article? Then click on the orange "follow" button at the top of the page to be notified the next time we publish an article on dividend investing.

If you want to learn more about our "Dividends First" approach, and are ready to commit to your dividend freedom, you should consider trying "The Dividend Freedom Tribe" 14 days totally free of charge. Click here to learn more.