Introduction

It’s been more than two years since I last checked out EnerSys (NYSE:ENS), and in those months, the EnerSys share price has barely moved up and has been a clear underperformer. That being said, the share price has bounced back nicely from its COVID-19 lows, so I decided to revisit my previous bullish stance on this company to see if it makes sense to get back in this battery producer at the current levels.

The cash flows remain positive in the first half of the year

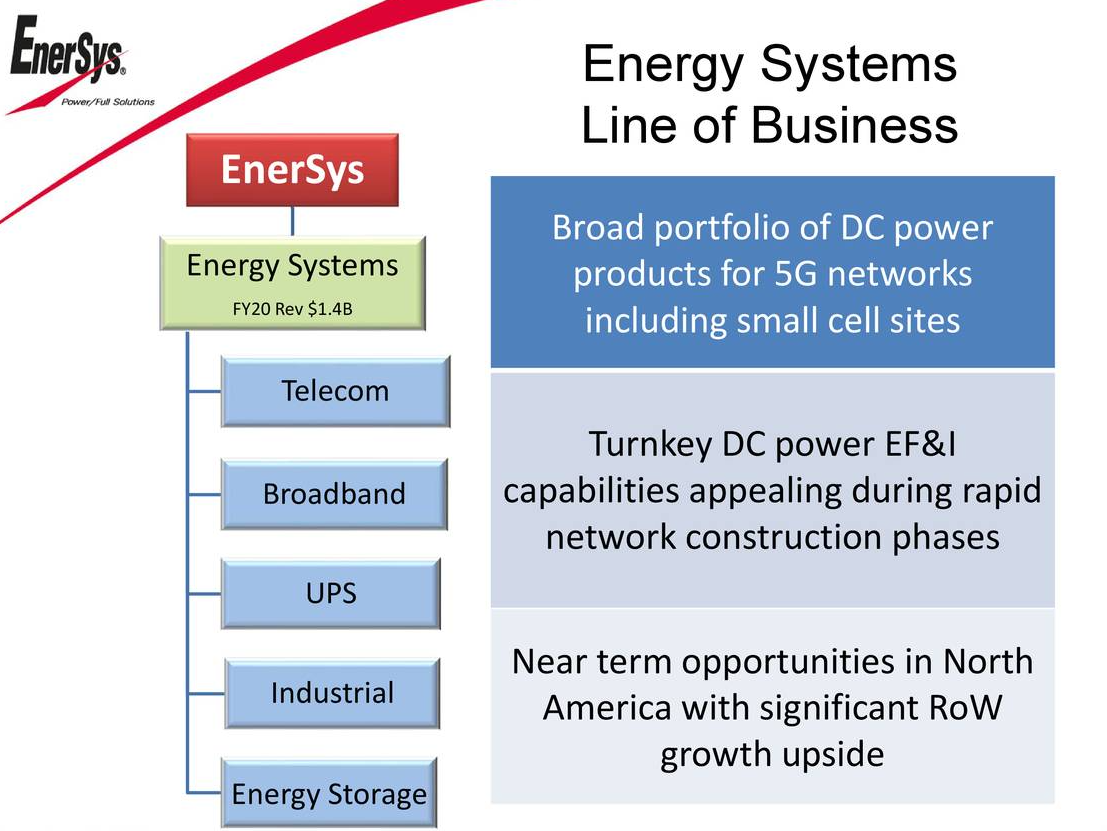

EnerSys remains very much dependent on its energy systems and motive power divisions, and although the COVID-19 pandemic clearly resulted in a slowdown, the company’s performance remained quite resilient.

Source: Company presentation

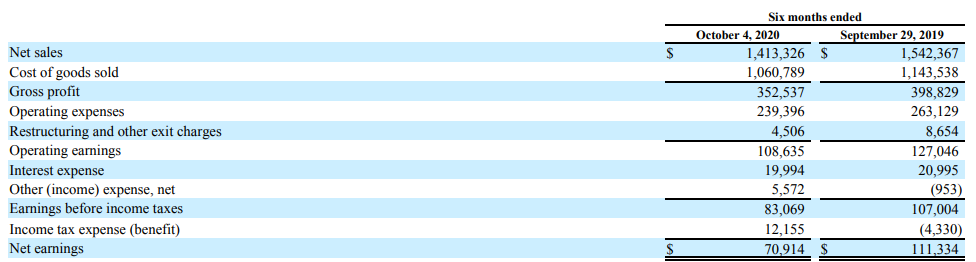

EnerSys definitely wasn’t immune and in the first six months of the financial year the revenue decreased by a high single-digit percentage to $1.41B. Fortunately a substantial portion of the business is scaleable and EnerSys was able to reduce its COGS and a chunk of its operating expenses accordingly. The almost $130M lower revenue ended up resulting in a decrease of the operating income by less than $19M – although this also was helped by a much lower restructuring expense compared to the first semester of the previous financial year.

Source: SEC filings

The net income of almost $71M wasn’t entirely comparable to the $111M in H1 FY 2020 as there was a tax benefit of $4.3M recorded in the first half of the previous financial year while the average tax rate in the first half of the current financial year was approximately 14.7%. Still quite low but it obviously makes a comparison with the net income in H1 2020 a bit more difficult.

The cash flow statement provides a better overview as it does provide a partial adjustment for the

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!