Digital Realty (NYSE:DLR) is a company with strong fundamentals and good growth prospects over the long term, offering an attractive dividend yield compared to its peers.

Company Description

Digital Realty is a real estate investment trust (REIT) for federal income tax purposes, which has been established in 2004. Digital Realty is one of the largest listed REITs in the U.S. with a market capitalization of about $37 billion.

It is focused on providing data center, colocation and interconnection solutions for its customers. The company owns, acquires and manages technology-related real estate, containing applications and operations critical to the daily operations of technology industry tenants and corporate enterprise data center tenants.

Its portfolio is comprised of 284 data centers, as of the end of last September, of which the vast majority is located in the U.S. Internationally, Digital Realty owns data centers mainly in Europe, Brazil, and Asia-Pacific, but the company has global ambitions and is expected to continue to add new regions to its asset portfolio.

Business Model and Competition

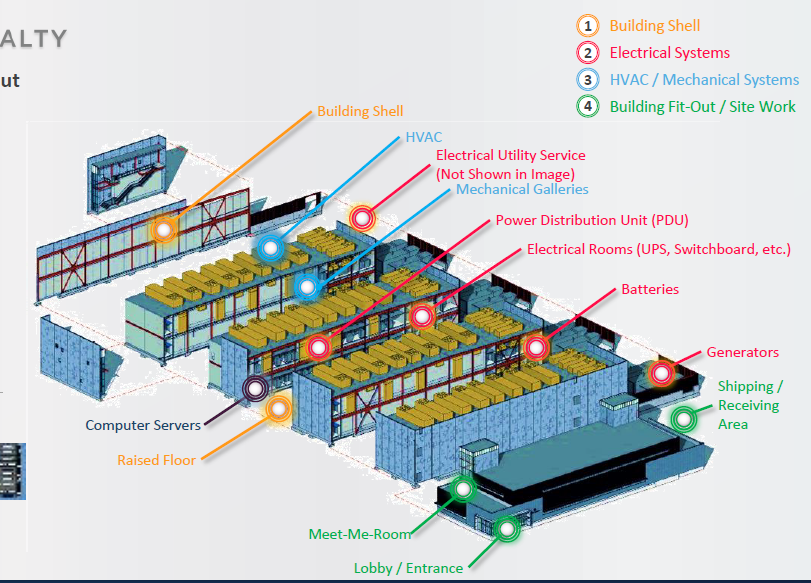

Its business is centered about data centers, which are facilities designed to house servers and network equipment as can be seen in the next graph. A data center has several pieces of hardware, including electrical and mechanical systems, while the principal component is computer servers. These servers, which process and store data, are supplied and owned by the company’s customers.

Source. Digital Realty.

This means that Digital Realty’s business model is basically to provide a space for customers to place their computer services in exchange for a recurring fee. This is an outsourcing of space from its customers to the company, which usually have offices in locations that are more expensive, while data centers operated by Digital Realty are located in cheaper real estate locations.

The data center industry is