Introduction

Summit Materials (SUM) is a vertically integrated construction materials company with a focus on the production of concrete products and aggregates. Although the company’s share price was punished for missing the Q3 expectations, I think the company still offers upside value as the free cash flows remain strong, even when you include investments in additional growth.

The net income was boosted thanks to a tax benefit, and the free cash flow remained strong

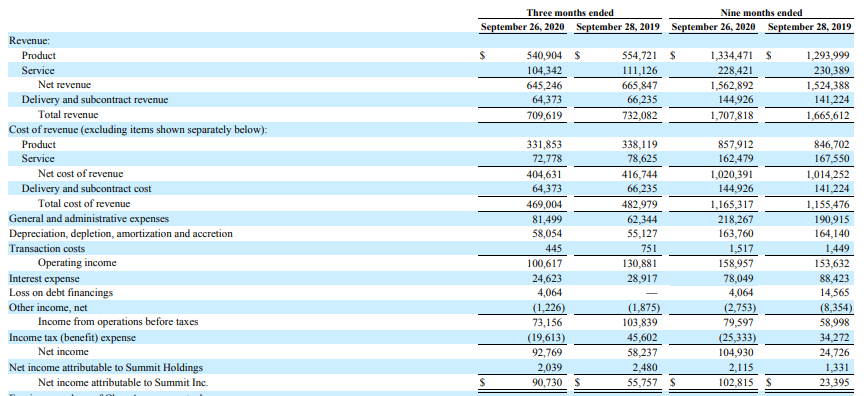

Summit Materials was able to boost its revenue in the first nine months of the year, despite reporting a revenue decrease of almost 3% in the third quarter (which was one of the main reasons why the share price fell). The revenue decrease wasn’t really a reason to be concerned, as you can see on the image below, the COGS also decreased by almost 3% but what really killed the Q3 performance was the 30% increase in the G&A expenses which increased from $62M to $81M.

Source: SEC filings

These high G&A expenses reduced the operating income by almost 25% to just over $100M and despite the lower interest expense (which was mitigated by a one-time cost related to a loss on debt financings), the pre-tax income fell by 30% to $73M. Interestingly, the company recorded a tax benefit of almost $20M and that’s the main reason why the Q3 EPS came in almost 60% higher than the EPS in Q3 2019. But of course, excluding this tax benefit, Summit Materials was clearly missing the expectations on a normalized and underlying basis. Keep in mind the tax benefit will be a one-time item as the company reversed unrecognized tax benefits to the tune of almost $33M.

The net income in the first nine months of the year more than quadrupled to $103M or $0.90 per share, but this was

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!