We often forget about this simple principle, but the stock market is always ahead of the economy. Therefore, when things look bad (high unemployment rate, the world economy slowing down, etc.), the stock market can go up. In fact, investors anticipate the impact of a vaccine along with all that "free money" being printed or borrowed at ultra low interest rates. Therefore, the market goes up while we pile up bad macro environment news.

What will happen this year? Economic news is going to improve, and likely stocks will go sideways or even decline. Why is that? Because all the good that could happen in 2021 is pretty much priced into the market now. What can you do about it? Nothing.

The tricky part is that if the economy grows accordingly to expectations, not much will happen. However, surprising news (both good and bad) could happen too! The underlying force of having so much liquidity in the stock markets will likely support another year of growth. However, I wouldn't be surprised if we have a "no return year" in 2021. I predict dividend growth investing will get all its appeal back in this more challenging investment environment.

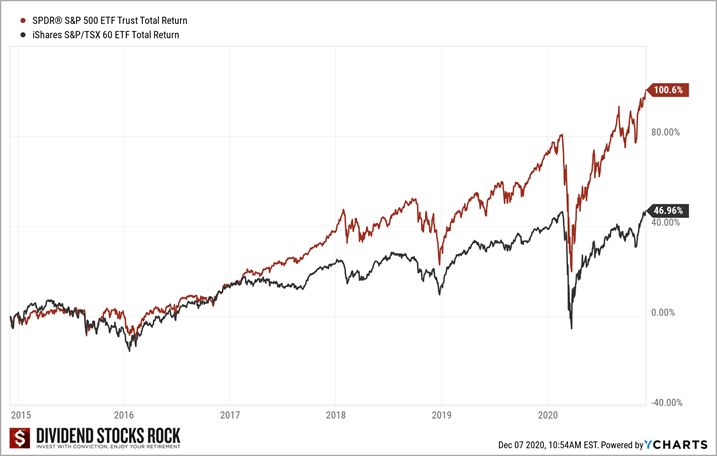

Last year was quite a roller coaster! If there is one single piece of wisdom you must remember from 2020, it is this: stay invested. If you stayed invested since December 2014, your portfolio is now clearly in better shape now with the US market having doubled in value and the Canadian market being up 50%.

What will 2021 bring us as investors? More dividends! Today, I will share with you two stocks that are amongst my Top Picks for 2021. The selection methodology of those companies is explained in this article:

Sysco (SYY)

- Market cap: 39B

- Yield: 2.36%

- Revenue growth (5yr, annualized): 1.67%