REV Group Inc. (NYSE:REVG) is a manufacturer and distributor of specialty vehicles recognized for its leading platform in emergency public services like fire trucks and ambulances. The company also produces school and transit buses, street-sweepers, along with a portfolio of recreational vehicle "RV" brands. While the company faced disruptions in 2020 due to the COVID-19 pandemic, the latest quarterly results were highlighted by improving demand and firming margins. Shares have rallied in recent months to trade at a 1-year high and we see more upside through 2021 supported by operational momentum. Rev Group is uniquely positioned to benefit from future fiscal stimulus efforts aimed at funding state and local agencies that represent an important segment of end-users. This is an overall quality stock with a positive long-term outlook.

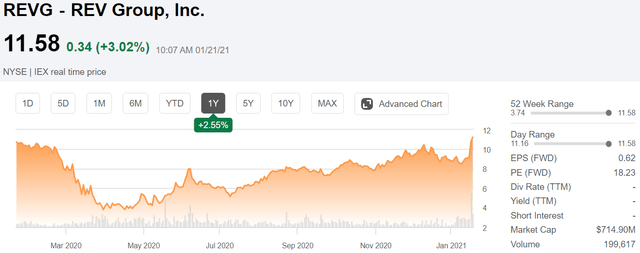

(Seeking Alpha)

REVG Earnings Recap

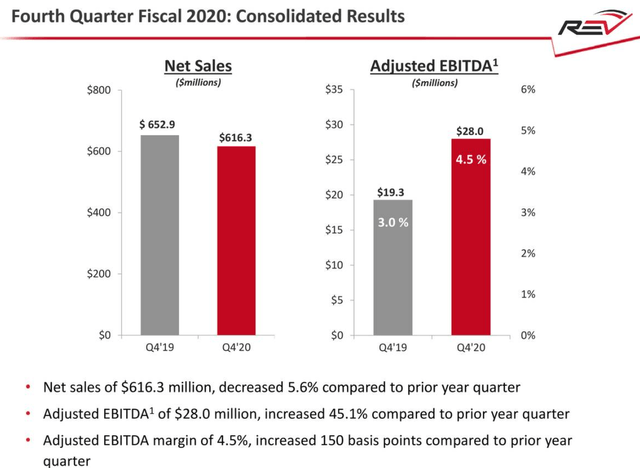

REV Group reported its fiscal 2020 Q4 earnings on January 7th with non-GAAP EPS of $0.19, in-line with estimates. A GAAP EPS loss of -$0.16 reflected some impairment and restructuring charges related to cost cuts and strategic changes implemented over the past year. While net sales of $616 million declined by 5.6% year-over-year pressured by a particularly weak commercial segment, firm-wide adjusted EBITDA of $28 million was up 45% year over year driven by higher margins.

(source: Company IR)

The story here was otherwise strong results from the fire and emergency "F&E" segment where revenues climbed 23% y/y to $330 million and now represent over 50% of the total business. The company acquired 'Spartan Emergency Response' in early 2020, solidifying its market leadership in the segment. Notably, the company has a backlog of $966 million in this segment supporting a strong growth outlook. Ambulances have been in high demand, in part based on the pandemic, adding to operating income in the segment. Management highlighted its manufacturing facility in Florida during the

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.