Reasons for Not Owning WFC Until Now

My reasons for avoiding Wells Fargo and Co. (NYSE:WFC) are well documented. Between 2016 and 2018, I wrote four articles concerning WFC's problems. Here are links to those articles:

- 9/29/2016: "Looking For Buy Signal On Wells Fargo? Watch Insiders."

- 10/4/2016: "Looking For Buffett's Plans For Wells Fargo: Here Are The Facts."

- 11/30/2017: "Wells Fargo: Here's Why It's Time to Play Defense."

- 3/27/2018: "Wells Fargo: Despite 3% Dividend, Avoid Until This Happens."

The material banking issues cited in the articles:

- By far the most important: Pervasive and material failures in internal controls. The 2017 article provides a comprehensive list of these failures.

- Profound concern that the bank's board of directors lacked the skill and experience to govern WFC.

- Aggressive intervention by WFC's two primary regulators: Federal Reserve and the Office of the Comptroller of the Currency.

- Skepticism of the bank's ability to cut operating expenses in the face of pervasive internal control and risk management failures.

- Skepticism of the bank's ability to buy back shares while under intense regulatory scrutiny,

- Absence of insider buying even as share prices fell from high $50s to low $20s.

- Concern Warren Buffett would sell WFC shares after holding 10% ownership, thus flooding market with shares.

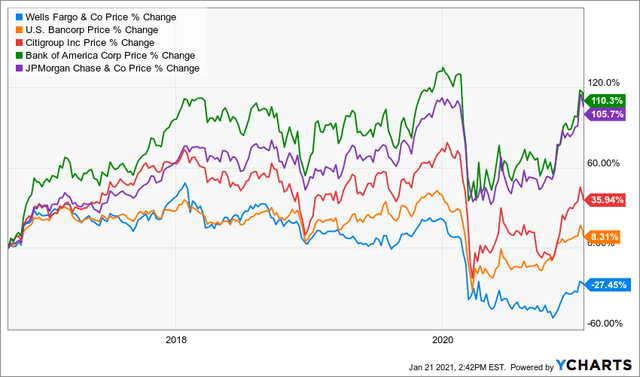

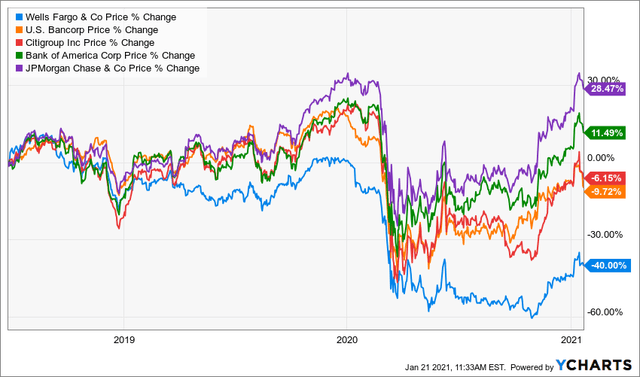

My preference to own JPMorgan Chase (JPM) for the past 5+ years as my primary megabank holding has been rewarded on a relative basis to WFC. Chart 1 shows price change since the date of the first WFC article and chart 2 shows price change since the fourth article was published. Five years from now I expect WFC to show the greatest price gain of the five megabanks.

Chart 1

Chart 2

What's Different Now?

WFC has been on my radar since early last year when shares fell to under $30. My hesitation