The Invesco DWA Technology Momentum ETF (NASDAQ:PTF) is, as you likely have deduced from the title, a fund focused on investing only in companies exhibiting powerful momentum (i.e. strong relative strength). PTF is based on the Dorsey Wright Technology Technical Leaders Index, and you can find more detailed information about that index and its methodology here. The portfolio holds at least 30 NASDAQ listed companies and is re-balanced and reconstituted on a quarterly basis. The expense ratio is 0.60% and the current market value $395.2 million. For more information on the fund, here is PTF's homepage.

Holdings

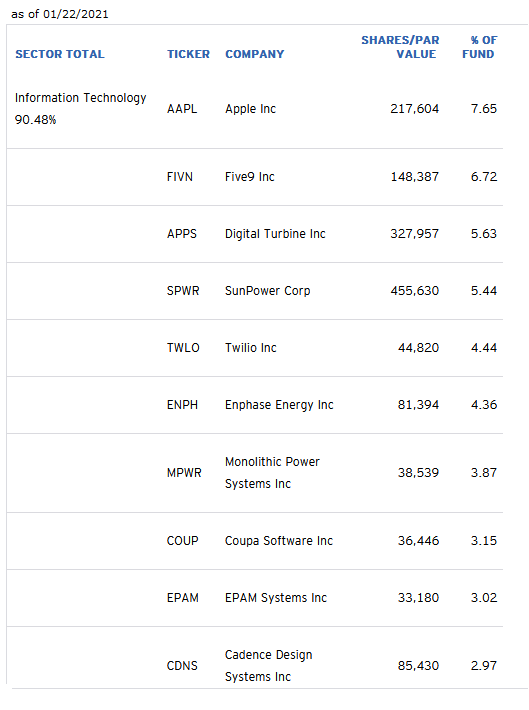

A list of PTF's top-10 holdings is shown below:

Source: Invesco

Source: Invesco

Surprising to me, Apple (AAPL) holds the top position in the portfolio with a 7.65% weight. Right behind it is Five9 Inc. (FIVN), a leading provider of cloud contact-center software. The momentum behind clean energy is represented in the portfolio by #4 SunPower (SPWR) and #6 Enphase Energy (ENPH) - two solar energy focused companies that have really been on a roll since President Biden was elected. That's due to expected 180-degree policy shift from "making coal great again" to "making America clean again".

The #7 holding is Monolithic Power Systems (MPWR). Monolithic is a semiconductor company riding high supplying solutions for the telecom infrastructure, cloud computing, and EV markets. Coupa Software (COUP) is a global leader in procure-to-pay (P2P) solutions. COUP also provides its customers with benchmark and data analytics information. EPAM Systems (EPAM) is a software engineering, design, development, and consulting firm. Rounding out the top-10 holdings is Cadence Design Systems (CDNS), a provider of EDA tools, IP, and engineering design resources for chip design engineers.

The chart below shows the performance of the top-5 holdings in comparison to the performance of PTF over the past year:

As can be