RELX plc (NYSE:RELX) is a somewhat undercovered British publisher and information provider with a lot of attractive businesses. My investment thesis is that its solid business model, niche market, and strong cash flows make it a stable long-term choice for dividend growth and likely share price appreciation. I see it having a strong future as it has a strong position in a number of areas where its capabilities are highly sought after by deep pocketed client types such as law firms and insurers.

While it is not a bargain at its current price, I do think it represents long-term value.

RELX's Market Space is Attractive and Resilient

A digital future is a positive thing for RELX, which has shown that it can thrive in a highly digitalized environment. Although it has publishing roots with medical journals and other academic publications, the company has transformed with the digital age and these days is an information services provider. This enables it to obtain revenues without incurring concomitant printing costs. Its information is regarded as must have by readers, such as legal resources like LexisNexis.

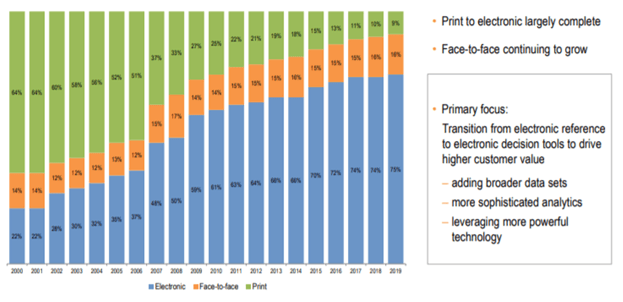

So, the digital age has harmed many publishers but has helped RELX, by cutting out some of the costs of physical production and circulation without damaging revenues. Indeed the print part of RELX's business is in rapid decline, with the company registering a 17-19% underlying decline in its print sales in the first half of 2020. By contrast, during that pandemic-impacted period, the electronic division registered underlying growth of 3-4%. Indeed, the shift from print to digital is almost total at this point, as the chart below shows.

Source: company investor presentation

It targets professional users such as law firms, medical practitioners and the insurance industry. That is good for margins, as such customer bases often need the information, on which RELX