Most of my articles tend to be long and rather involved. Today's idea is a bit of a departure from that. Today, I'd like to share why I think Meredith Corporation (MDP) is a buy at current prices. My basic thesis is that MDP has managed to weather the Covid-19 storm very well, yet that accomplishment hasn't yet been reflected in the stock price.

If the company continues to generate positive cash flows, as I believe it will, then it can de-lever its balance sheet and the equity will benefit disproportionately given the company's low market cap / EV ratio.

Meredith

Meredith is a media company operating in two segments.

(source)

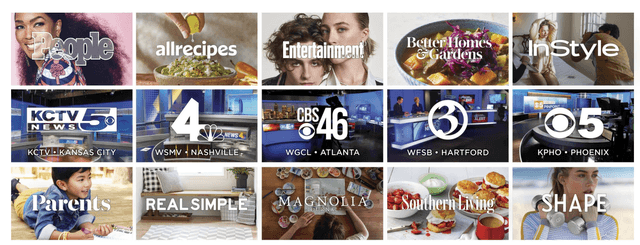

The "National Media" segment features a number of consumer brands such as "People", "AllRecipes", "Entertainment Weekly", "Better Homes & Gardens" and "InStyle".

These brands allow MDP to reach more women than any other comparable media company, as illustrated in the slide below.

(source)

The "Local Media" segment operates 17 television stations that include 7 CBS affiliates, 5 FOX affiliates, 2 MyNetworkTV affiliates, 1 NBC affiliate, 1 ABC affiliate, and 2 independent stations. It also includes 12 Websites and 12 applications focused on news, sports, and weather-related information. (From company profile.)

The company has suffered from running a dying legacy business in print, but I believe that the number of initiatives that the company is adopting will not only leverage their existing assets, but should position them for future growth.

Many of these initiatives were discussed on the recent earnings call, so for interested readers, I recommend reading the entire transcript, but in the following, I will highlight what I believe to be the most salient points.

The following two slides layout how the company is thinking about these new opportunities. The first slide shows all of the new ways that