This dividend ETF review series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios.

DGRW strategy and performance

The WisdomTree U.S. Quality Dividend Growth Fund (NASDAQ:DGRW) tracks the WisdomTree U.S. Quality Dividend Growth Index, which is a strategy following systematic rules. The SEC Yield of DGRW is currently 1.95%.

As described in the prospectus,

The Index is comprised of the 300 companies in the WisdomTree U.S. Dividend Index with the best combined rank of growth and quality factors. The growth factor ranking is based on long-term earnings growth expectations, while the quality factor ranking is based on three year historical averages for return on equity and return on assets. The Index is dividend weighted annually.

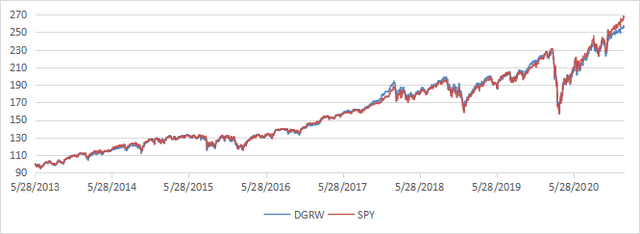

Since inception (05/22/2013), DGRW is almost on par with the S&P 500 (SPY), which is an excellent performance among dividend-oriented ETFs.

Annual.Return | Drawdown | Sharpe ratio | Volatility | |

DGRW | 13.01% | -30.13% | 0.89 | 13.94% |

SPY | 13.61% | -32.05% | 0.92 | 14.04% |

The next chart plots the equity value of $100 invested in DGRW and SPY since DGRW inception.

Comparing DGRW with a reference strategy based on dividend and quality

In previous articles, I have shown how some factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, Altman Z-score, Payout Ratio.

The next table compares DGRW since inception with a subset of the S&P 500: stocks with an above-average dividend yield, an above-average ROA, a good Altman Z-score, a good Piotroski F-score and a sustainable payout ratio. The subset is rebalanced quarterly.

Annual.Return | Drawdown | Sharpe ratio | Volatility | |

DGRW | 13.01% | -30.13% | 0.89 | 13.94% |

Large cap reference subset | 12.41% | -32.79% | 0.8 | 15.17% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

DGRW marginally beats this dividend

QRV Stability is a portfolio of dividend stocks aiming at outperforming dividend equity ETFs. Quantitative Risk & Value (QRV) provides you with a toolbox and educational content to implement data-driven strategies and monitor market risks. Get started with a two-week free trial and improve your investing decisions from day one.