How many times did you use your cell phone over the weekend?

You don’t remember? Too many times to count?

Fair enough. How about just yesterday?

If, as expected, you still have no idea, don’t worry. This isn’t a test you have to pass. It’s a set-up question to prompt you into some deeper thinking on the subject of cell tower REITs.

Which are enormous investments on almost every level I can think of.

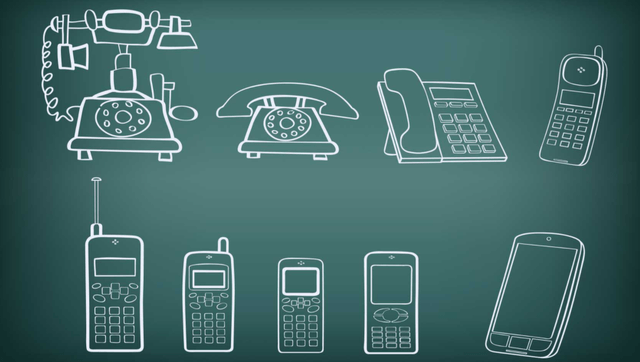

The fact that you can’t remember how many times you used yours says as much. Because, at this point, most of us take our cell phones – especially our smartphones – for granted.

We use them to make calls. We use them to make texts. We use them to play games. We use them to do searches. We use them to make payments. We use them to take pictures.

We use them. We use them. We use them.

And every time we do, we give greater value to the communication structures they’re sent through…

Even if the market’s opinion of that value isn’t so hot at the moment.

Where Cell Tower REITs Stand Today

To give a quick but helpful overview of the cell tower real estate investment trust (REIT) subsector, I’m going to quote my new book. Chapter 7 of The Intelligent Investor – due out in just a few months! – includes this insight:

“Unlike many other REIT structures, the wireless tower model is simple and straightforward. Wireless devices (i.e., basic phones, smartphones, tablets, connected cars, etc.) transmit data over the air via wireless spectrum, from radios inside the devices to those mounted at the top of towers, or cell sites. That data is transferred back to the core network over fiber or copper lines – or spectrum, in some situations – then directed toward the appropriate end user’s location via the nearest tower.”

Ask the REIT Expert

We recently launched the iREIT on Alpha iQ (Q stands for Quality) scoring model in which we let data determine the best REITs to own based on QUALITY. Our members can now get full access to this sophisticated screening tool. Our coverage spectrum includes equity REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and, more... 2-Week FREE TRIAL plus my FREE book.

Don't miss dozens of C-suite interviews on my "Ground Up" podcast