In this article, I'll focus on one of my favorite types of businesses - personal care and hygiene. It doesn't matter how the economy goes or how things fare in general. People always need hygiene products. You can't stop visiting the bathroom just because of a crisis, and people usually don't elect to go without personal hygiene unless they absolutely must.

That makes investing in these sorts of businesses a generally excellent idea, provided that we're looking at a well-run sort of business. I believe Kimberly-Clark (NASDAQ:KMB) is that and has the potential to be an appealing investment for your portfolio.

Let me show you why.

(Source: Kimberly Clark)

Kimberly-Clark - What does the company do?

KMB is a 149-year old personal care company. Originally founded in Wisconsin, the company for the longest time operated its own paper mills, therefore being vertically integrated, but has since closed these to focus on production.

The company has a market cap of around $45B and owns extremely strong global brands which on an individual level exceed $1B in revenues each.

(Source: KMB Investor Presentation)

You can't really argue with this data, as it goes beyond simply "appealing", and goes into "necessary".

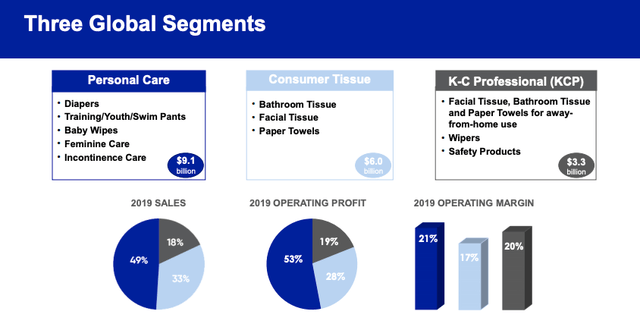

The company's operations are structured into three easily-understandable operating segments.

(Source: KMB Investor Presentation)

These, by and large, mirror the offerings of peers such as Essity (ESSYY). While not as international as Essity, 48% of 2019 sales come from non-NA geographies, but almost 70% of the company's operating profit comes from NA. This is due to the margin mix/breakdown, with international markets only bringing in a 13% operating margin for KMB, whereas NA margins are almost twice that. The company's focus and dominance in the US are therefore more understood.

Sales in a company like this are very stable over time, with only