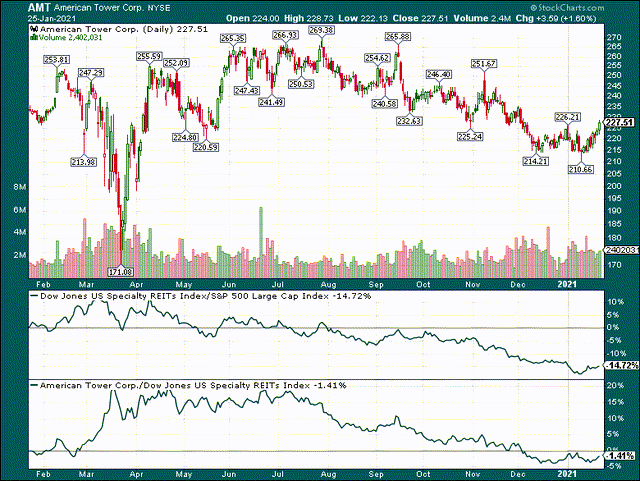

REITs have been a pretty awful place to have your money since the pandemic hit. Just about any other group I can think of has outperformed REITs as they’ve been left in the proverbial dust by the broader market, and in particular, growth stocks. However, that has created a few situations where leaders in the space find themselves with reasonable valuations, and intact long-term stories. One such example is American Tower (NYSE:AMT).

AMT has been in a downtrend since the summer of last year and while that’s certainly been unpleasant for shareholders – as the indices have soared – if you have new money to invest for the long-term, AMT looks pretty attractive to my eye.

The stock is currently in an uptrend that has taken out the prior relative high, so that’s a good sign that $210 may have been the bottom. There are numerous resistance levels overhead, but given the value proposition for AMT today, I’m less concerned about the chart and am more enticed by the valuation and the dividend growth potential. If you’re on the hunt for a REIT to buy, AMT has to be on your list.

A model with long-term upside

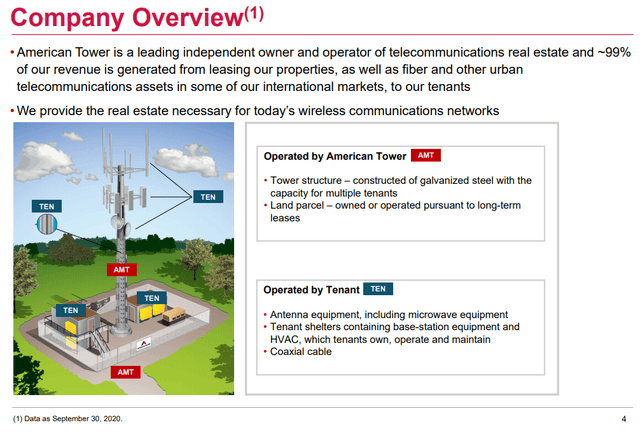

AMT operates a really simple business model; it buys and operates telecom real estate and leases it out to tenants that need to transmit data wirelessly.

Source: Investor presentation

As you can see, AMT buys the ground and builds a tower, and then the tenant buys pretty much everything else. In return, AMT gets leasing revenue for the tower which is very high margin, and margins improve exponentially as AMT adds more tenants to each tower.

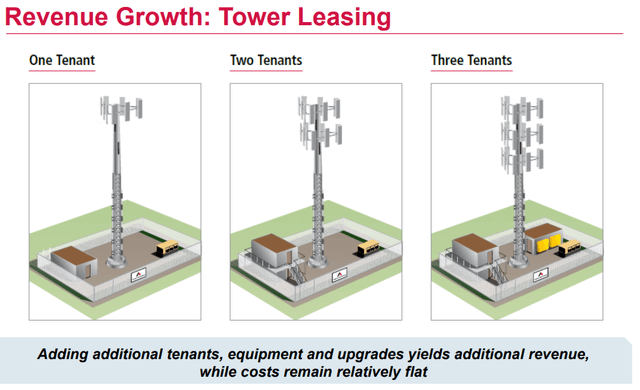

Source: Investor presentation

This example shows how AMT can build a tower in a desirable spot and lease it to multiple tenants over time given