Introduction

About three months ago, I wrote an article on Timberland Bancorp (NASDAQ:TSBK) when the company seemed to be trading at just 7 times its earnings, and the 4% dividend yield appeared to be well-covered. Just a few days later, Pfizer (PFE) announced positive vaccine news and the $19.99 share price Timberland was trading at when the article was published is now just a distant memory. But this doesn’t mean Timberland is now expensive. The Q1 results confirmed my expectations, and the bank remains relatively cheap.

The Q1 2021 performance was pretty good

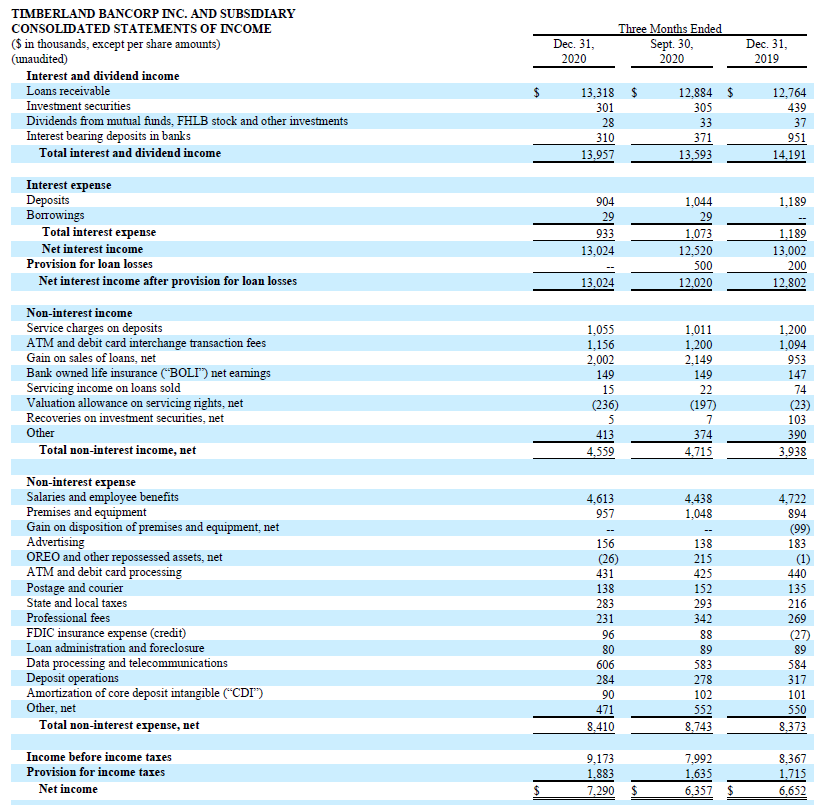

Despite the continuous pressure on the banks due to a decreasing interest rate, Timberland was able to increase both its interest income as well as its net interest income compared to the last quarter of last year. As you can see on the next image, the total dividend income increased by almost 3% to just under $14M while the interest expenses decreased by 15%. 15% sounds like a lot, but considering Timberland is paying virtually no interest anymore on the funds it has access to, the 15% decrease in interest expenses is really just a saving of $140,000. However, the combination of a higher interest income and a slightly lower interest expense caused the net interest income increase by approximately 4% to $0.5M to $13M in Q1 compared to Q4 last year.

Source: SEC filings

As the total non-interest expenses remained relatively stable, the pre-tax income increased from $8M in Q4 to $9.2M in Q1 2021 resulting in a net income of $7.3M or $0.88 per share ($0.87 on a diluted basis). The strong net income result was helped by the lack of any provision for potential loan losses in the first quarter of the current financial year Although the bank only put aside $0.5M in Q4 (which hardly

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!