Introduction

While I continued to look through the financial results and balance sheets of small regional banks, I bumped into Columbia Banking System (NASDAQ:COLB). Hardly a small local player with a market capitalization of almost $3B and a total balance sheet size of in excess of $16B, I'm surprised to see the bank hasn't gotten any attention here on Seeking Alpha since 2017. Although the full annual report for 2020 still has to be published, I already had a closer look at the FY 2020 results which were announced last week.

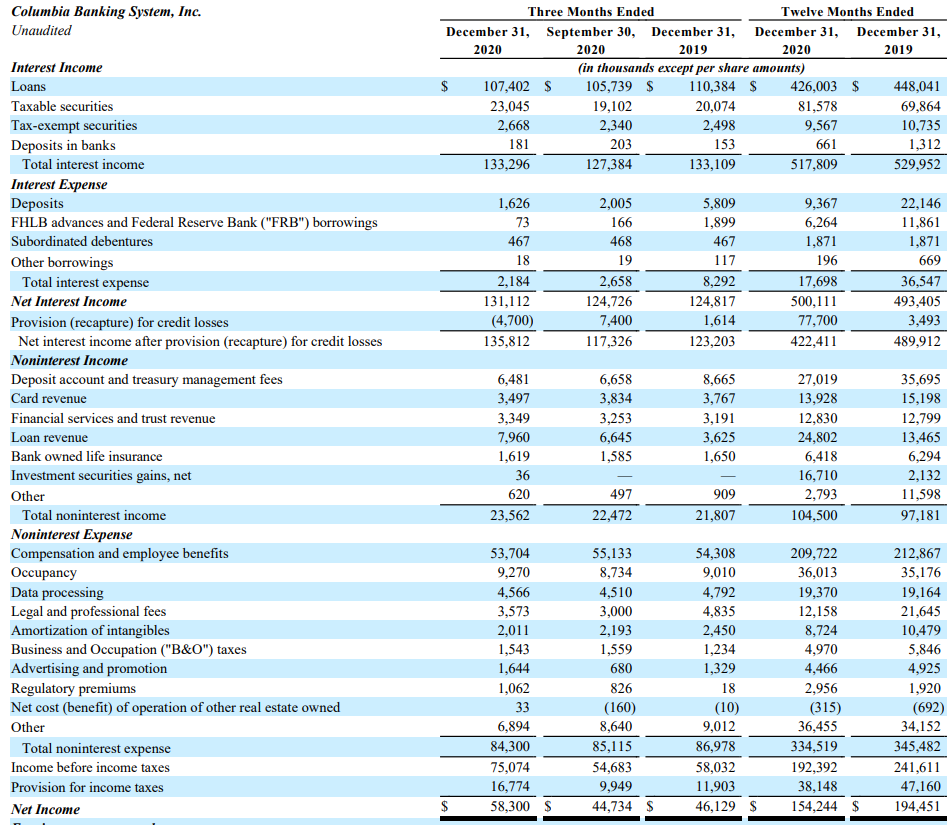

The net interest income increased in FY 2020

While most banks seem to be suffering from the low interest rate climate, Columbia Banking System has actually been able to increase its net interest income, both on a QoQ basis as on a YoY basis. As you can see on the image below, Columbia reported a net interest income of $131.1M in Q4 2020 which is both higher than the $124.7M in Q3 2020 as well as the almost $125M in Q4 2019. That's an important achievement considering the bank had already reduced its total interest expense on deposits to less than $6M as of the end of 2019 which, given the almost $11B of deposits, was already pretty low.

Source: SEC filings

We notice a similar increase in the net interest income on a full-year basis as the FY 2020 net interest income increased from $493M to just over $500M although the bank likely has to thank the PPP loans for the strong performance.

Moving over to the Q4 non-interest expenses, we see the net non-interest expenses (mainly staff expenses) was approximately $61M. That was a little bit surprising considering that's a lower non-interest expense compared to both Q3 2020 as well as Q4 2019. And we again see a similar trend on a full-year

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!