MarineMax (NYSE:HZO) is the world's largest boating dealer specializing in premium brands and luxury yachts. This is a market segment that was particularly strong in 2020 with industry sales surging to a 13-year high as consumers gravitated toward outdoor recreation options during the pandemic. Indeed, MarineMax just reported its latest quarterly results highlighted by strong growth and record earnings.

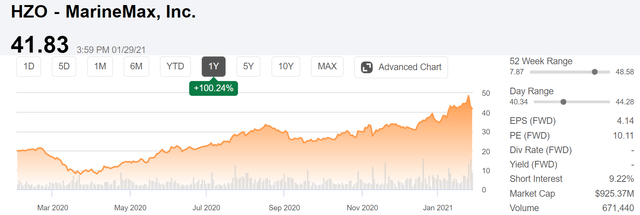

Even as shares of HZO are up over 100% in the last year, we remain bullish on the stock which still offers attractive value supported by continued operating momentum and solid fundamentals. MarineMax is likely to benefit from the ongoing demand tailwinds with its services business driving margins and earnings higher.

(Seeking Alpha)

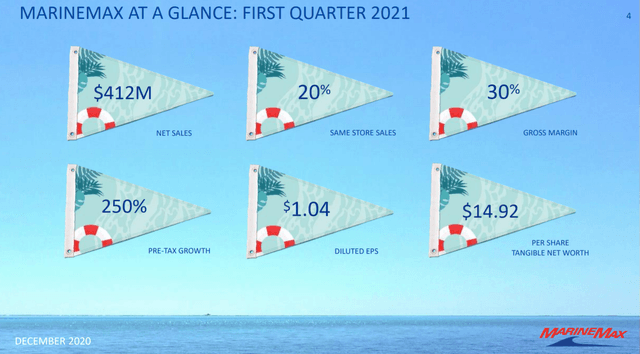

HZO Earnings Recap

MarineMax reported its fiscal 2021 Q1 earnings on Jan. 28 with GAAP EPS of $1.04, which beat expectations by $0.47. Net income in the quarter at $23.6 million was up 159% from $9.1 million in the period last year. Revenue of $412 million also was above the consensus and represented a 35% year over year increase. Same-store sales based on its worldwide network of over 100 locations climbed 20% y/y highlighting the operating momentum. The top-line growth supported a 370 basis point increase to the gross margin reaching 30%, up from 26.3% in Q1 fiscal 2020.

(Source: Company IR)

This was a record quarter for the company, continuing the trend going back to the early part of last summer when the demand for boats really took off. As mentioned, The National Marine Manufacturers Association "NMMA" industry group recently reported retail unit sales of powerboats climbed 12% in 2020 to 310,000 units, the highest level since 2008.

By this measure, MarineMax with fiscal 2020 sales up 22% y/y outperformed the broader industry implying they captured market share. Highlights over the past year include acquisitions of Northrop & Johnson

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.