Truist (NYSE:TFC) is hardly a household name, even though it is the sixth largest bank holding company in the U.S. (market cap of almost $65B). BB&T and SunTrust banks merged in December 2019 and the new entity was named Truist. The name is derived from the words trust and true and is supposed to alleviate some of the negative perceptions people have about banks. The name has attracted ridicule but the merged entity appears to be running smoothly.

TFC's forward P/E is 12.1, the TTM P/E is 15.6, and the yield is 3.75%. TFC's yield is the highest from among its peers (regional banks), albeit just slightly higher than FITB's 3.73%. The payout ratio, at 45.5% is not unreasonable. The company just declared their $0.45 quarterly dividend on January 26th, and the ex-div date is February 11th.

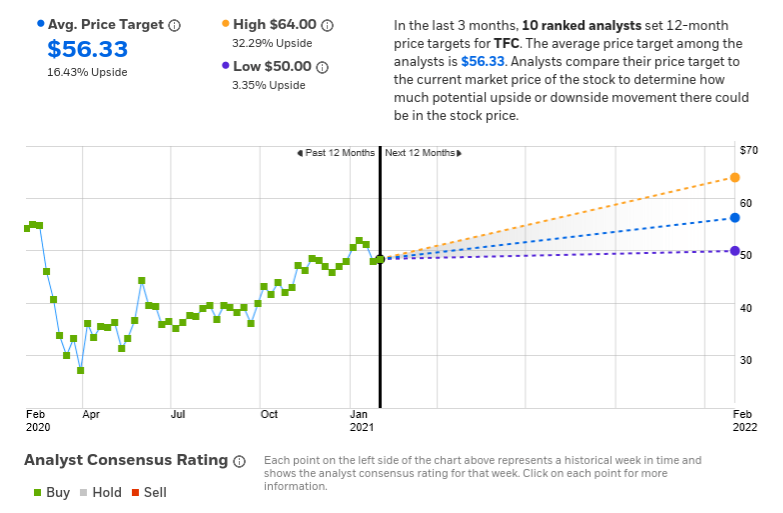

The Wall Street analysts who follow TFC have a positive outlook, with an average projected price appreciation of 16.4% from the current price over the next twelve months. Even the lowest price outlook implies a 3.35% price gain over this period.

Analyst price forecasts (Source: eTrade)

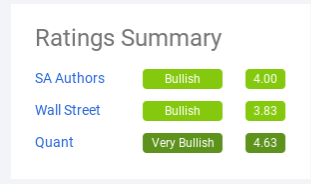

The SeekingAlpha.com quantitative rating for TFC is bullish, as is SA author rating, although the stock is very lightly followed at Seeking Alpha.

Seeking Alpha summary outlook (Source: SeekingAlpha.com)

The picture that emerges is consistently positive. The valuation is fairly low, the dividend yield is high (given current market conditions) and looks sustainable. In addition, the company has beaten the consensus earnings estimate over the past five quarters, most recently with Q4 2020 earnings on January 21, 2021. TFC's stock price has fallen by more than six and half percent over the past twelve months, generally in line with U.S. financial firms. The iShares U.S. Financials ETF (IYF) has seen its price decline by three and