While numerous green energy names have been receiving some love on the hopes of a climate-focused, clean energy transition promoted by the Biden administration, solar technologies have been identified as potential long-term winners over the next decade as expansion could be fueled by cost reductions. As such is the case, SolarEdge (NASDAQ:SEDG), one of the leading inverter producers with global reach and over 21 GW in total shipments, could be poised for more upside as its valuation relative to key peer Enphase (ENPH) provides downside protection after solar stocks' rallies.

Decreasing Solar Costs can Drive Adoption

Solar technologies have continued to grow and improve to date, and "solar costs [are estimated] to fall another 15% to 25% over the next decade [as s]ilicon-based modules will remain the dominant technology, but become more efficient and gain higher power ratings." With decreasing costs, solar could become the "the lowest-cost source of new generation" and a leading form of clean energy by 2030, although changes in federal subsidies over the course of the next few years could impact deployment growth.

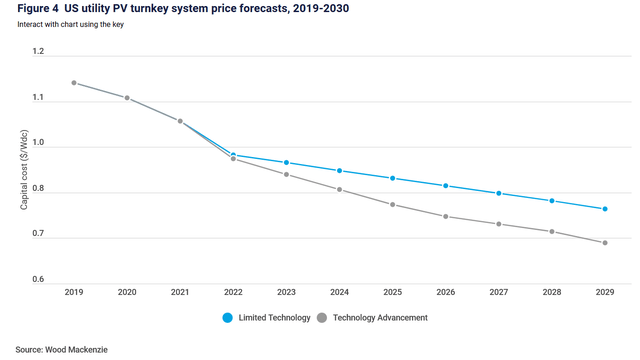

Modules and trackers remain the two highest hardware costs, yet advancements in module tech like bi-facial modules, larger wafers, and higher efficiencies have helped decrease module costs, while better engineering has helped a more widespread adoption of trackers. However, DC inverters are the third highest hardware cost, SolarEdge's main market, and improvements in this field also can facilitate solar adoption by contributing to decreasing hardware costs. Inverters are necessary for AC conversion, and "larger inverters can reduce project size, lower the need for wiring and other electrical equipment and reduce operating costs by limiting points of failure." Prices for turnkey systems could decrease to $0.7/w by 2030 with technological advancement (higher efficiencies + better trackers and inverters), from ~$1.1/w in 2020.

Variations in