Synnex Corporation (NYSE:SNX) has performed well since spinning off its Concentrix business unit, with the shares returning 11.7% since the beginning of December. Investors tend not to like complex business models, especially when it comes to disparate product lines with few synergies.

This made the original company difficult to value, considering Concentrix had a different margin profile than the TS (Technology Solutions) unit. The spin-off also allows Synnex’s management to focus on the remaining TS business, and I see this as creating shareholder value in the long run. In this article, I evaluate what makes Synnex worth buying at present, so let’s get started.

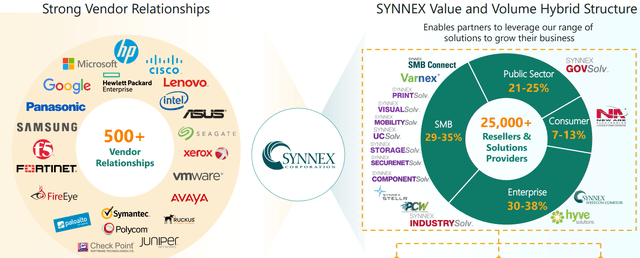

(Source: Company website)

Why Synnex Is A Buy

Synnex Corporation is a Fortune 200 company and a leading provider of technology distribution, systems design, and integration services for the technology industry to a wide range of enterprise business customers. It was founded in 1980, and operates in North and South America, Asia, and Europe. To understand the company’s scale, Synnex distributes over 40K technology products across 25K resellers, systems integrators, and retailers.

As seen below, Synnex partners with some of the biggest names in tech, including Microsoft (MSFT), Cisco (CSCO), Intel (INTC), and Samsung (OTCPK:SSNLF). Its customers are also well-diversified, with about a quarter going to the public sector, and much of the rest about evenly spread between Enterprise and SMB (small and medium business). I see this as being a strong plus, as it reduces Synnex’s reliance on any one sector, and can carry the company through various economic cycles.

(Source: Jan’21 Investor Presentation)

The remaining business post spin-off, TS (Technology Solutions), continued to execute well during the pandemic, with FY’20 (ended November 2020) revenue growing by 4.8% YoY, to $20 billion. I’m also encouraged by the adjusted operating margin holding rather steady, at 2.9% compared to 3.0% in 2019.