Source: cloud.vmware.com

Investment Thesis

At first glance VMware (VMW) appears to be one of the less exciting names in today's highly growing cloud space. Relative share price performance to the overall sector confirms this view, but as we'll see down below - there is a catch.

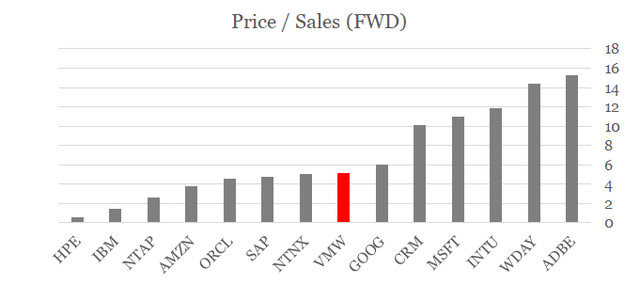

As a company with legacy on-premise services, VMW is not among the high-flying names in the sector. As such, its relative valuation to other peers in the sector is very conservative.

Source: prepared by the author, using data from Seeking Alpha

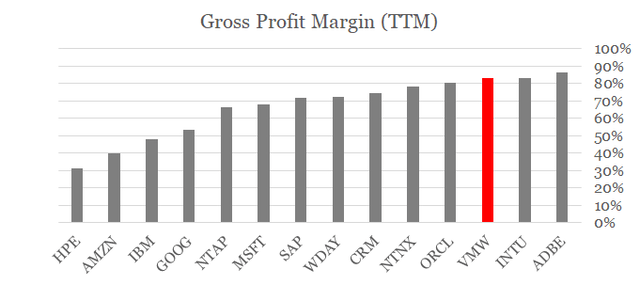

Nevertheless, VMW is among the most profitable companies in the industry on a gross margin basis. The reason why this is important is that contrary to operating margins, which also depend on scale and the level of Research & Development spend necessary to fuel growth for high-growing companies, gross margin is more indicative of the overall quality of the business model.

As far as top-line growth is concerned, on-premise license sales declined for the past year and are expected to grow at a modest rate in the coming year. VMW's subscription and SaaS sales, however, are experiencing double-digit growth.

VMW is also a leader with sustainable competitive advantages in key areas for the cloud, such as Server Virtualization and Unified Endpoint Management (UEM). As such, the company is uniquely positioned to be a partner of choice for almost every public, private and telco cloud provider.

Last but not least, Dell's intention to spin off its 81% stake in the company could be an important catalyst for VMW's share price as it will give the company a wider recognition by institutional investors.

A closer look at the business and its competitive advantages

VMware is a leader in server virtualization with its mature service offering - vSphere, which is unrivaled even by other big