SEDG in a nutshell

SolarEdge Technologies, Inc. (NASDAQ:SEDG) offers inverter solutions for solar photovoltaic (PV) systems through a suite of products that includes SolarEdge Power Optimizers (power fine-tunning), SolarEdge Inverters (inverters), StorEdge Solutions (energy storage) and SolarEdge Monitoring Software (monitoring and smart energy management).

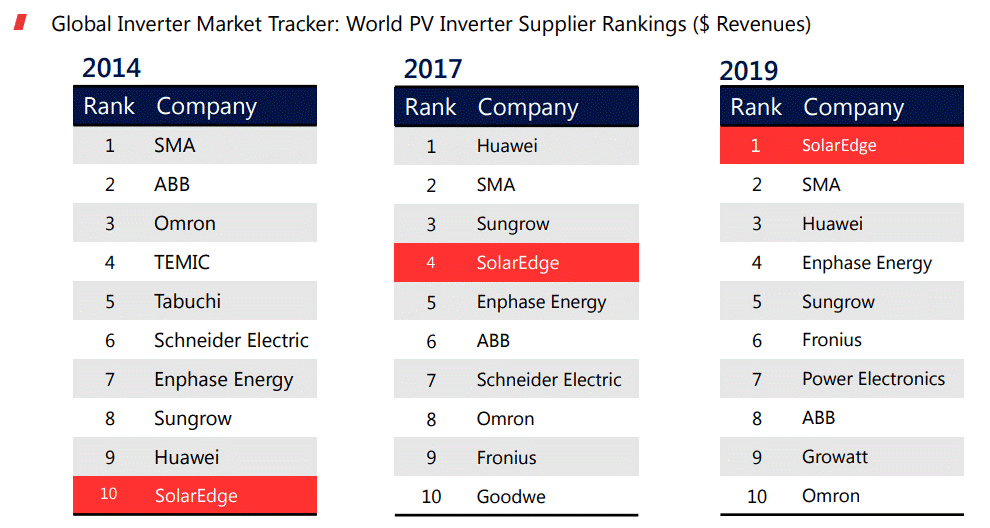

SEDG is a global company with nearly half its revenue generated from the United States, 14% from the Netherlands, and the rest of Europe accounting for roughly one quarter of the total revenue. Optimizers and Inverters account for the bulk of SEDG's top-line with each generating approximately 45% of overall sales. Bottom line, SEDG's integrated solution consists of a direct current (DC) power optimizer, an inverter and a cloud-based monitoring platform that has helped the company obtain a leading position in the Solar PV inverter market.

Figure 1. Ranking the world's largest inverter suppliers by total revenues in 2014, 2017 and 2019. (Source: IHS PV Inverter Market tracker 2015-20)

SEDG is firmly entrenched in a duopoly position with both US Residential and International Growth potential

SEDG has significant exposure to the US Residential market whereby along with Enphase Energy (ENPH) the two control more than 75% of the market, a clear market duopoly. While SEDG market share in 2019 was around 60%, in 2020, ENPH has slowly stole some of that market share as the latter managed to realize the benefits of business shifts between 2015-2018, while SEDG's production facilities overseas were hit by Covid-19 supply chain issues and Trump's Tariffs. Furthermore, ENPH's microinverters' business seems to have stolen business from SEDG's centralized inverter model despite the lower cost of the latter. That said, it is important to recognize that the variability of market share data in the US converter niche remains significant due to dramatic differences in the figures reported by consulting firms such as Wood Mackenzie.