Source: Kellogg's

Investment Thesis

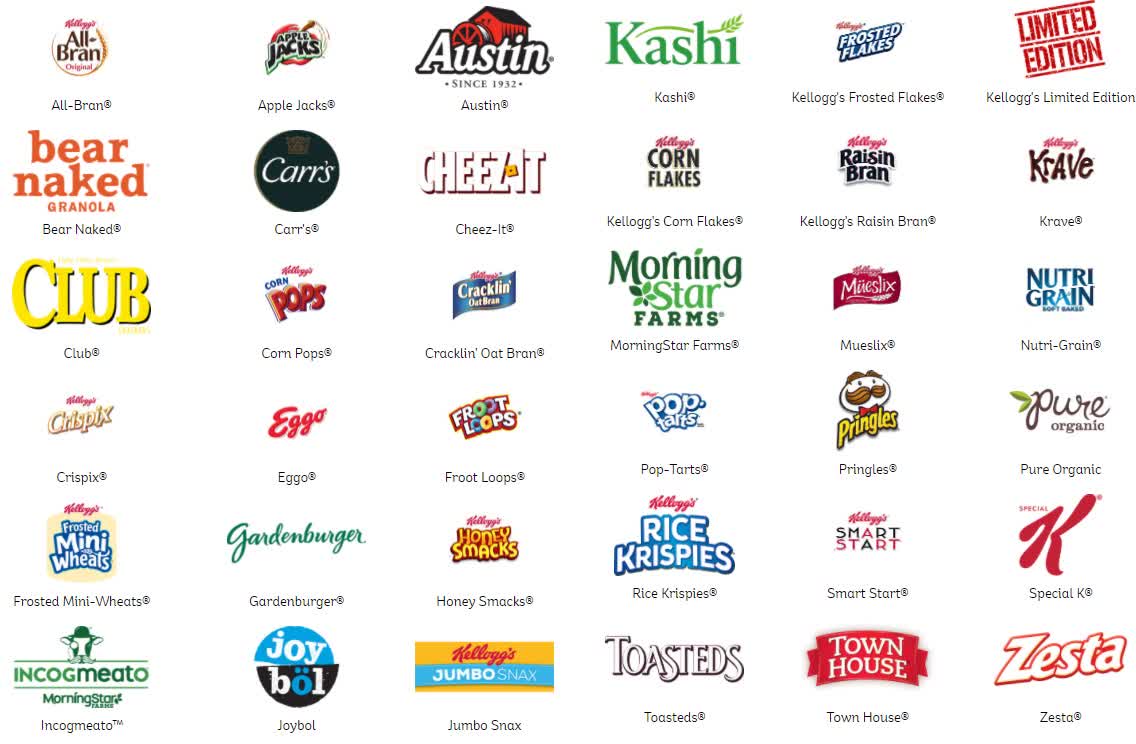

Kellogg (NYSE:K) is a consumer staples giant that is woven into the fabric of breakfast and snacking for a great deal of households. From iconic breakfast cereals like Special K and Frosted Flakes, to Eggo Waffles, Nutri Grain bars, and Pop Tarts, they are in a great deal of our households. Kellogg also has more health conscious/forward offerings like Kashi, RxBar, and Morningstar plant based offerings. While a great many people have Kellogg's somewhere in their kitchen myself included, I am assessing if Kellogg might belong in my portfolio.

I'm a big fan of delicious cereal and a tasty cookie, and Kellogg has me covered on that front, but I am a bigger fan of an above average dividend and good value. Just like I prefer to buy my Corn Pops on sale, I want to get my income generating investments on sale too. That's exactly the opportunity I am seeing right now at Kellogg. In fact I would say that most of the Kellogg offerings could be described much the same way as the stock at this moment, slightly above average, but not without some small faults, and worth buying on sale.

What I see with Kellogg right now is a fairly attractive entry point based on value, into a company with an above average dividend yield and a relatively safe capital appreciation outlook. While both debt levels and slow growth are slight tics against K, I believe that they certainly are not deal breakers, in fact I see debt moving in the right direction and growth may have some additional runway. Based on historic multiples, as well as the dividend yield relative to historic levels the current price, $58.03 at the time of this writing, presents a discount and a buying opportunity.