Investment Thesis

BlackRock (NYSE:BLK) is the world's largest asset manager and well-known for its iShares ETF family. There is a strong underlying trend towards passive investing and the GameStop (GME) saga created new potential long-term customers. A generation of burned investors is looking for a more conservative, reliable investment strategy. If you are done with single stocks, just buy them all.

Introduction

BlackRock is the world's largest asset manager with $8.67T assets under management. It is well-known for its largest division, the iShares ETF family. iShares is the largest ETF provider in the US and in the world.

I am going to discuss in this article BlackRock's strong performance and fundamentals, the underlying shift towards passive investing and why I think that the GameStop saga can have a positive long-term impact on the business. The current stock price is evaluated based on historical multiples and company-specific risks are discussed.

It's a well-managed company

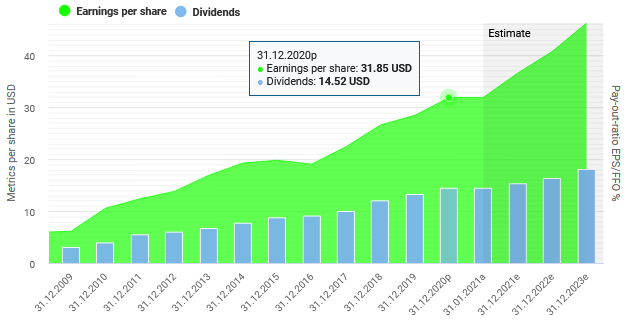

BlackRock showed an excellent performance over the last years. Let's have a quick look at some key parameters, starting with earnings per share and the dividends since 2009.

Source: DividendStocks.Cash

The EPS upward trend is really impressive, growing from $6.12 in 2009 to $31.85 in 2020 and analysts are very positive for the future. It's the same for the dividend. Just a few weeks ago, they announced a dividend increase of 13.8%. That makes the stock also very attractive for dividend growth strategies.

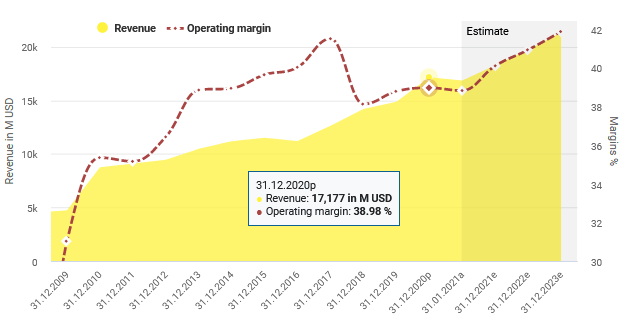

Revenue and operating margin confirm this positive impression.

Source: DividendStocksCash

In the last few years, the operating margin is slowly improving, trading at a high level of 38.9% in 2020. That's significantly higher than its competitor State Street (STT) with just 25.2%. In addition, considerable improvements are expected in coming years.

BlackRock's fundamentals are very strong with a reliable performance since many years. I consider