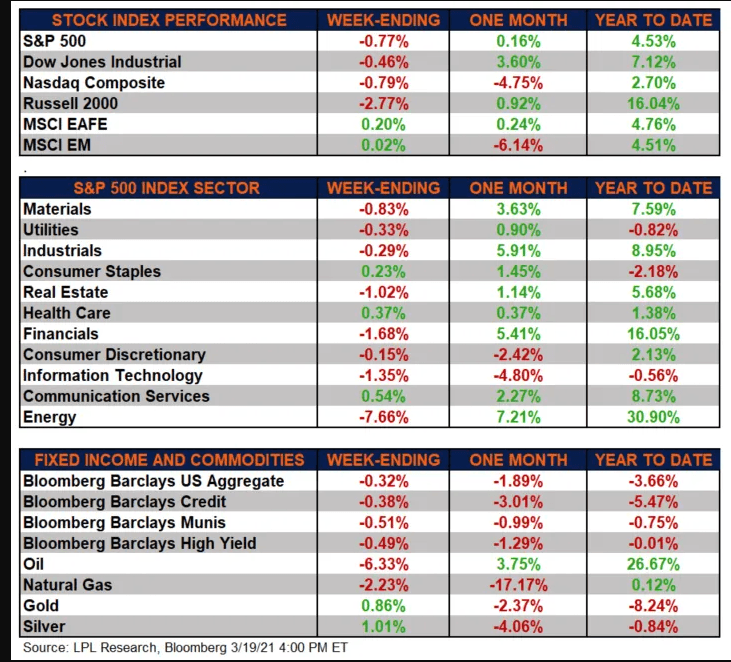

Starting the earnings update with a Twitter post from Ryan Detrick of LPL Financial. In particular note the sector return data.

Sector performance YTD in '21 is simply mirroring commodity price movements, probably not a surprise to many. Here are the sectors with the biggest increase in expected EPS growth estimates for 2021:

Energy - Since 12/31/20, the expected EPS growth for 2021 has increased from 672% to 767%, which is deceptive since we were dealing with negative numbers for 2020. Still the 30% return for the sector in 2021 speaks for itself. Energy fell 6-7% this week on the sharp drop in crude oil on Thursday, 3/18/21.

Basic Materials: +7.5% YTD for the sector, the expected sector EPS growth has increased from 30% to 39% since 12/31/20. Examining Morningstar's portfolio data on the Basic Materials ETF XLB, it is populated with a lot of names I've never followed.

Consumer Discretionary and Communication Services are both seeing their expected EPS growth forecasts reduced for 2021, both by about 1,000 basis points or 10%.

Technology, Health Care and the Financial sectors are all seeing modest upward EPS growth revisions since 12/31/20 for the full-year 2021 forecast. This blog updated the Tech sector's quarterly EPS expectations last night and the revisions continue higher.

S&P 500 Weekly Earnings data (source IBES data by Refinitiv)

The forward 4-quarter S&P 500 EPS estimate jumped to $175.60 this week from $174.91 last week.

The PE ratio is 22x the expected '21 estimate.

The S&P 500 earnings yield is 4.48% vs 4.44% last week and 4.23% as of 12/31/20.

Here's a change: the "average" combined 2020 and 2021 expected S&P 500 EPS growth has increased to 6%.

The expected 2021 S&P 500 EPS growth rate is now 25% versus 23% as of 12/31/20.