REIT Rankings: Office

(Hoya Capital Real Estate, Co-Produced with Colorado Wealth Management)

Office REIT Sector Overview

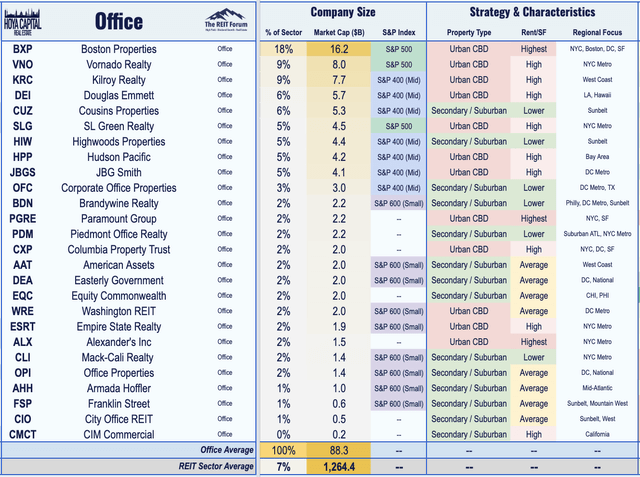

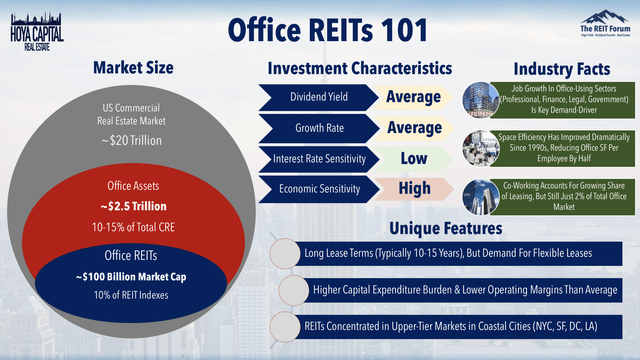

Is "Work-From-Home" the new normal? A year into the pandemic, office utilization in major U.S. cities remains a fraction of pre-pandemic levels with coastal cities facing a particularly slow recovery. The "reopening rotation" has boosted many of the urban office REITs to double-digit percentage gains this year despite weak quarterly results and a muted outlook. Within the Hoya Capital Office REIT Index, we track the 26 office REITs, which account for roughly $85 billion in market value. Office REITs comprise roughly 10% of the broad-based "Core" Equity REIT ETFs.

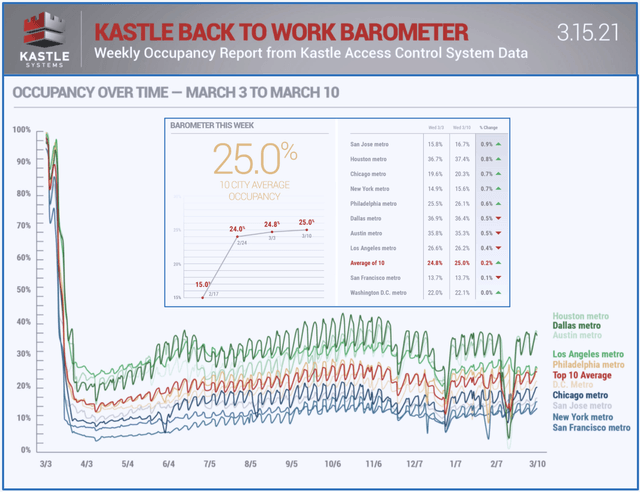

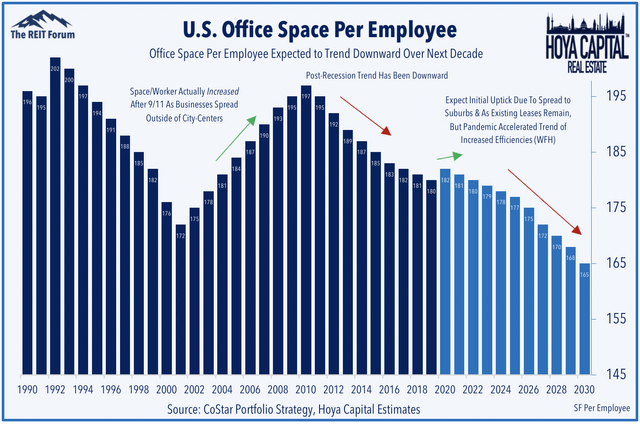

Survey data and commentary from corporations indicate that the WFH era is likely here to stay long after the pandemic subsides, as technology suites including Zoom (ZM), Slack (WORK), Google (GOOG), Microsoft (MSFT), and Amazon (AMZN) have emerged as an unexpected competitive threat to the traditional office ownership model. According to data from Kastle Systems, office utilization levels have not meaningfully recovered over the last six months in the largest U.S. cities. The "shutdown cities" - New York City, Chicago, Washington DC, and San Francisco - have been hit especially hard with office usage rates still below 20%.

Office REITs focus primarily on the higher tiers of the quality spectrum, owning nearly a quarter of all Class-A office buildings in the US. The sector is segmented into two categories. Urban CBD ("Central Business District") REITs hold portfolios that are concentrated in the six largest U.S. cities: New York City, Chicago, Boston, Los Angeles, San Francisco, and Washington, D.C., a segment that has been hit especially hard by the pandemic. Secondary/ Suburban REITs, which have generally outperformed in 2020, hold portfolios concentrated in the Sunbelt regions and/or in secondary markets.

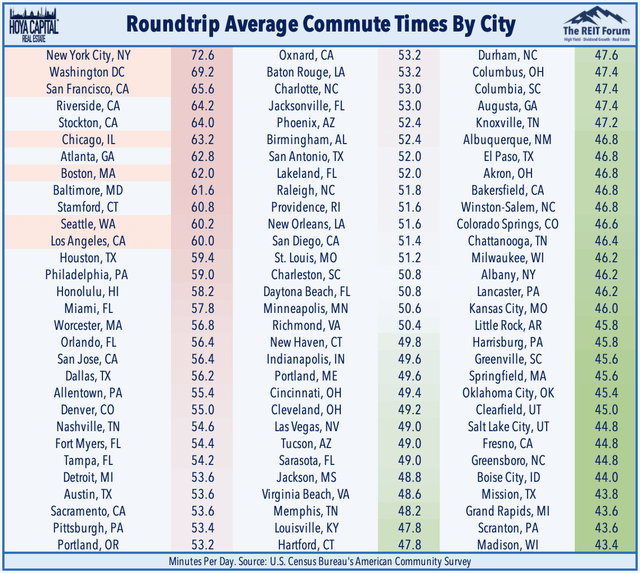

We believe that the permanence of WFH trends and the ultimate recovery in office demand will be quite uneven across metros, but patterns won't necessarily follow the standard urban vs. suburban dynamic. Instead, one overlooked factor determining how fast - and to what extent - employees return is employee commute times. Data from the Census Bureau's American Community Survey show that over the course of a typical 5-day work week, remote work employees in cities with particularly brutal commutes "save" an average of 6 hours per week and a hundred dollars in transportation costs.

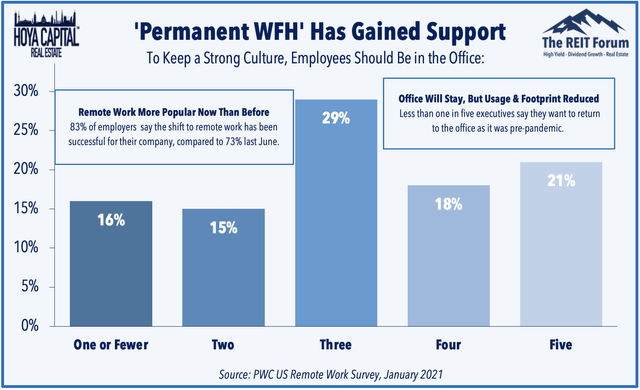

Thus, it's no surprise that recent survey data indicates that workplace flexibility is quite popular among both employees and executives. A recent PWC survey showed that the opinion of remote work has actually increased since early in the pandemic as 83% of employers now say the shift to remote work has been successful for their company. That's not to say that the office isn't going away, but corporations do expect to materially scale-back their real estate footprint. While 87% of employees say the office is important for collaborating with team members and building relationships, fewer than one in five executives say they want to return to the office as it was pre-pandemic.

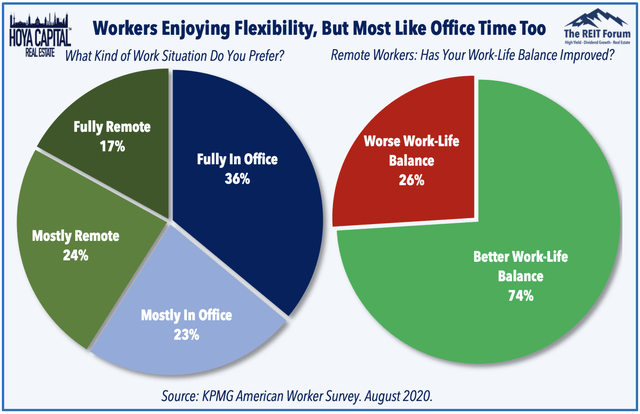

Importantly, WFH-related efficiencies are generally met with gratitude rather than contempt towards the employer, as well as improved productivity, according to a recent KPMG survey. While there are negative "side-effects" of entirely remote working - particularly for roles that require a higher degree of collaboration - the survey found that 74% of respondents that were working remotely as a result of the pandemic reported having an overall "better" work-life balance. Only a third of respondents expressed a desire to return to the typical five-day in-person work week.

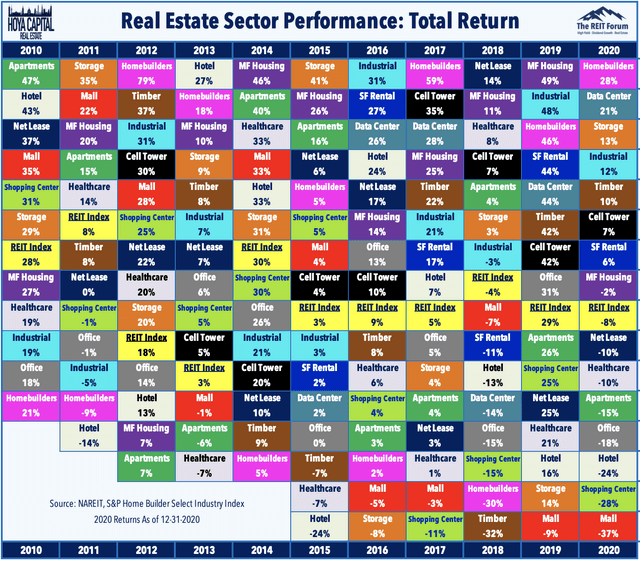

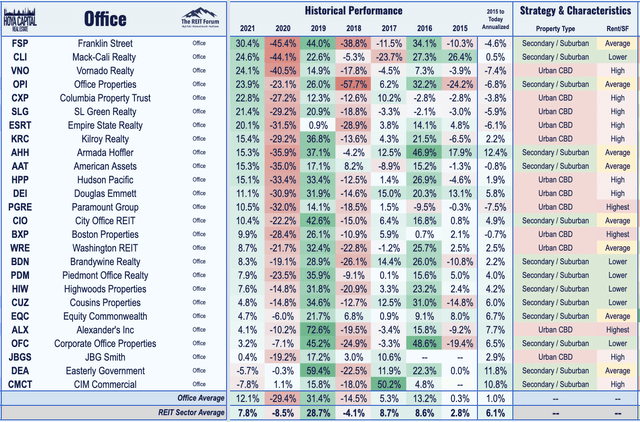

Office REITs Stock Price Performance

Office REITs were pummeled early in the pandemic, pressured by these lingering questions over the long-term demand outlook as businesses become more comfortable with the expanded utilization of WFH arrangements. The fourth-worst performing sector last year, office REITs ended 2020 with total returns of -18.44% compared to the -8.00% total return from the FTSE Nareit Equity REITs and the 17.60% gain by the S&P 500 ETF (SPY). From 2010-2020, Office REITs delivered average compound annual total returns of 9.1%, trailing the 12.6% average returns from the broader REIT index.

Hope for a 'Return-to-the-Office' revival? The vaccine-driven "reopening rotation" across the REIT sector has powered a rebound for many of the hardest-hit office REITs from last year. Secondary/Suburban REITs - particularly those focused on the Sunbelt region - generally delivered stronger performance last year, but trends have reversed this year with Urban CBD REITs bouncing back. Office REITs are higher by 12.1% this year, outpacing the 7.8% gains from the broad-based Vanguard Real Estate ETF (VNQ) and the 4.7% gain on the SPDR S&P 500 Trust ETF (SPY).

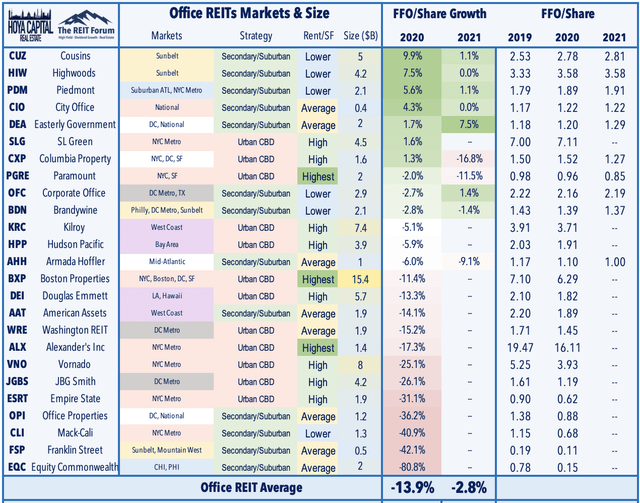

Office REIT Fundamental Performance

As discussed in our Real Estate Earnings Recap, the rebound this year comes despite recent quarterly results that showed punishing declines in Funds From Operations (FFO) and a muted outlook for 2021. Even as rent collection rates averaged over 95% throughout the pandemic, Office REITs still reported an average FFO/share decline of 13.9% for full-year 2020, by far the worst year on record, and the FFO forecast for 2021 looks even worse. Upside standouts throughout the pandemic have all in the secondary/suburban category led by Cousins Properties (CUZ), Highwoods Properties (HIW), Easterly Government (DEA), and Piedmont (PDM).

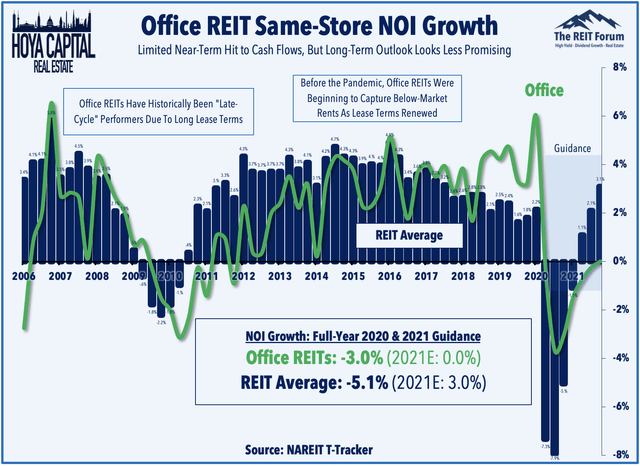

Office REITs were finally hitting their stride over the last two years following a decade of middling performance, powered by a seemingly unstoppable streak of job growth. The office REIT sector tends to outperform later in the economic cycle and respond more slowly to economic inflection points given the typically long-term lease structure inherent in office leases, which average 5-10 years for suburban assets and 10-20 years for CBD assets. Same-store NOI growth for office REITs averaged -3.0% in 2020, slightly "less bad" than the -5.1% REIT average and NOI growth will likely remain in negative territory through much of 2021 and perhaps into 2022 depending on the pace of reopenings.

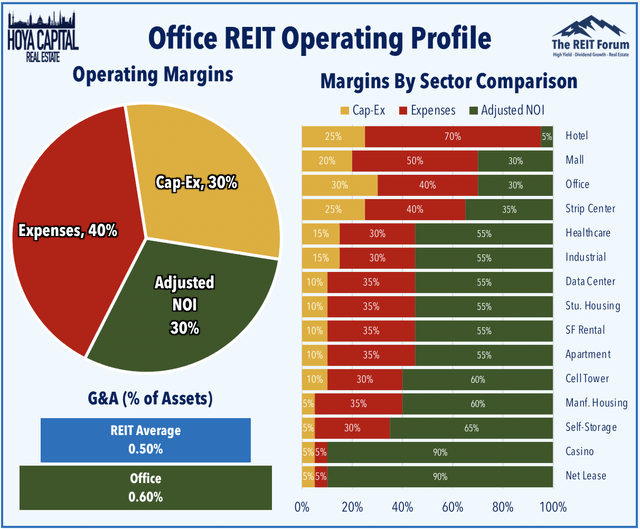

Even in the best of times, office ownership is a tough, capital-intensive business with relatively low operating margins and high capex needs, as tenants tend to have quite a bit of negotiating power relative to landlords, particularly given the ample available supply - a supply overhang that will linger for much of the next decade. Given the high degree of fixed costs incurred in managing an office property - whether fully occupied or mostly vacant - operating leverage is quite high. Thus, small changes in occupancy and market fundamentals can have significant negative impacts on NOI.

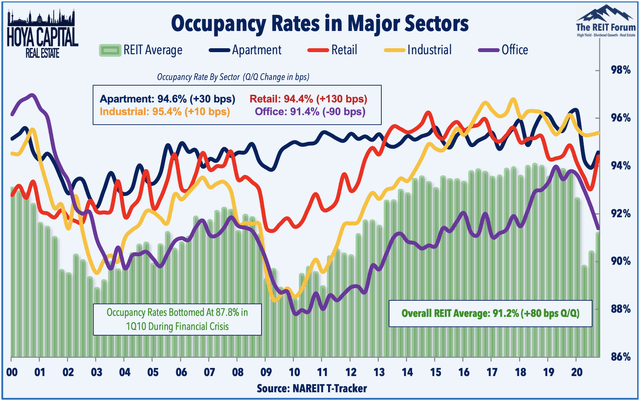

Power to the tenants. More than other REIT sectors, office REITs have a relatively small roster of tenants, and given the significant supply overhang from the combination of weak demand and continued supply growth, landlords will have impaired pricing power for the foreseeable future. Occupancy rates across the office sector declined sharply in Q4 - a trend that we expect to accelerate and eventually flirt with the prior lows from the early 2010s around 88%. In CBRE's 2021 U.S. Real Estate Market Outlook report, the commercial real estate brokerage firm commented that "office vacancy will persist at a stubbornly high rate and rent increases will be difficult to achieve as market conditions remain decidedly in favor of tenants."

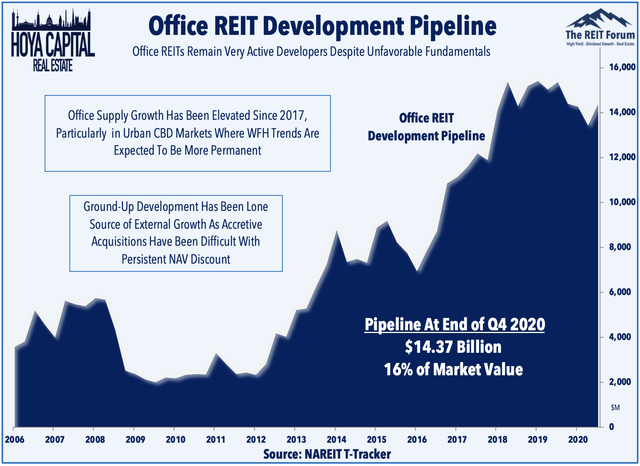

The supply dynamic hasn't helped, either, as construction spending on office development ramped-up again after the 2016 elections, spurred by the passage of corporate tax reform. With the recent pick-up in development, the office pipeline increased to a new cycle-high in late 2019 right before the start of the pandemic and supply growth has averaged more than 1.5% per year since 2017. According to NAREIT T-Tracker data, the office development pipeline stands at roughly $14.37 billion, up sharply from the 2012 level of $2 billion, representing 16% of office REIT market value which is by far the highest relative pipeline in the REIT sector.

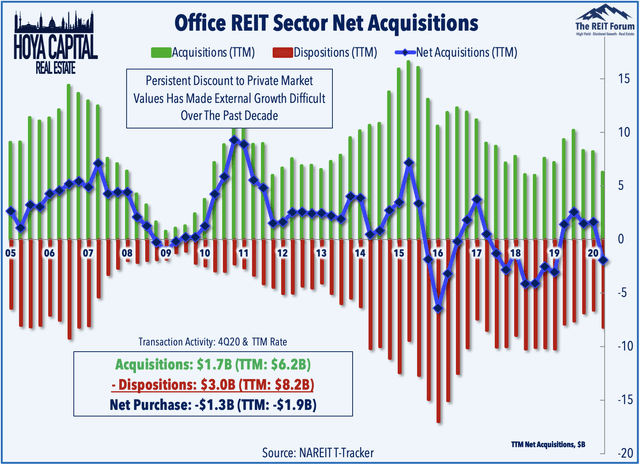

Ground-up development has been the lone source of external growth for office REITs over the past half-decade as accretive acquisitions have been made quite difficult by the persistent valuation discounts relative to private market valuations. On the private market side, office valuations have generally remained firm with declines of only about 5-10%, on average. As the markets thaw, however, we believe that office valuations in Urban CBD markets will reset lower by 10-15% over the next half-decade, in line with the projected decline in market rents. We believe that private market valuations will be relatively slow to "reset" and see this widening NAV discount as a continued headwind for these office REITs which will make accretive external growth via acquisitions all but impossible.

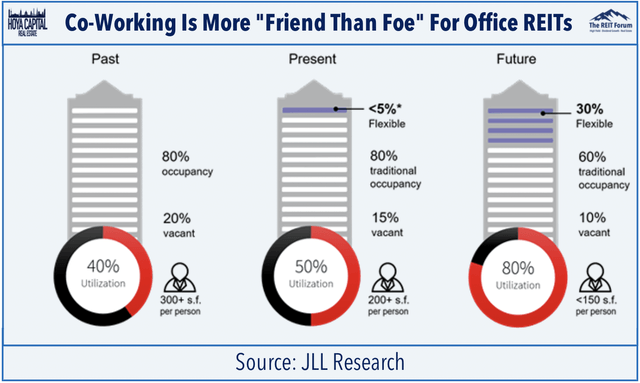

Additionally, the rapid growth of co-working – highlighted by embattled WeWork (WE) – had been one of the more significant demand drivers over the past half-decade, responsible for almost a third of total leasing activity over the past three years. The ongoing struggles of the co-working business model - made far worse by the coronavirus pandemic and resulting recession - potentially remove a significant chunk of incremental office leasing demand. Co-working firms are far more "friend than foe" for office REITs, serving as an intermediary to facilitate shorter-term space rentals and create incremental demand that would not otherwise be tenants of these office REITs.

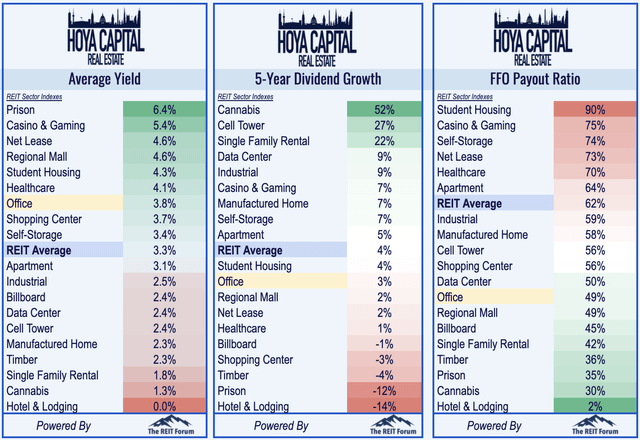

Office REITs Dividend Yields

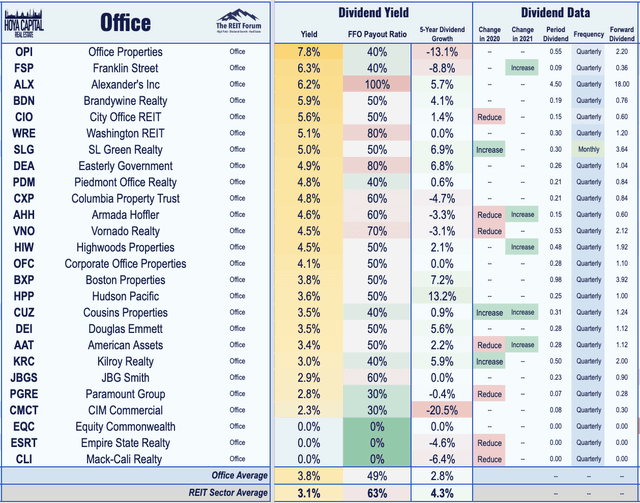

Office REITs have not traditionally been a sector known for high dividend yields, but office REITs now rank toward the top of the REIT sector, paying an average yield of 3.8% compared to the REIT sector average of 3.3%. Office REITs pay out roughly 50% of their available cash flow, towards the lower end of the REIT sector, but the sector has historically produced dividend growth that is below the REIT sector average.

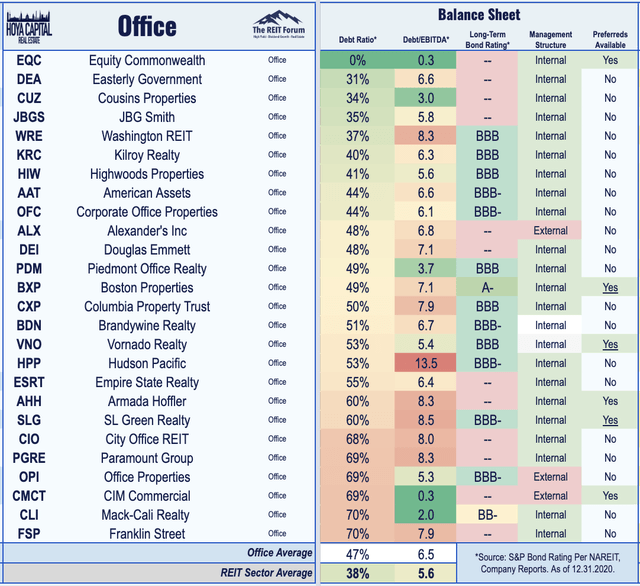

As anticipated, the pace of dividend cuts reversed across most of the REIT sector, but we believe that many office REITs that were able to "hang tough" in 2020 will face potential dividend cuts in 2021 or 2022 as market conditions continue to soften. With a 47% debt ratio, according to NAREIT, office REITs operate with leverage ratios that are above the REIT sector average of around 39%. Thirteen office REITs currently have debt ratios above 50%, while six REITs are above 60%, which we view as the "danger zone" for potential dividend cuts or other means of deleveraging.

Seven of the 26 office REITs reduced their dividend last year, but we've seen five REITs increase their distributions this year. There is a wide range of dividend distribution strategies employed by the twenty-six REITs within the sector, with yields ranging from 7.8% from Office Properties (OPI) to a low of 0% from Equity Commonwealth (EQC), Empire State Realty (ESRT), and Mack-Cali (CLI) - which announced this week that it will continue to suspend its common dividend for the remainder of 2021.

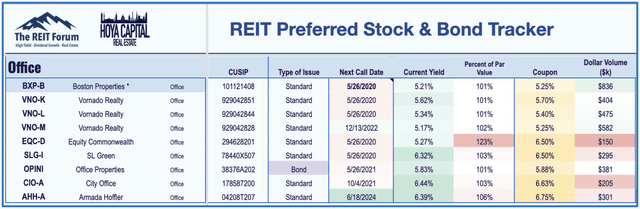

Investors looking to take the "preferred route" have several options. Seven of the 26 office REITs offer preferred securities or exchange-listed bonds: Vornado Realty (VNO, VNO.PL, VNO.PM), Equity Commonwealth (EQC.PD), SL Green (SLG.PI), City Office (CIO.PA), and Armada Hoffler (AHH.PA), all of which are standard cumulative preferred securities. Meanwhile, Boston Properties (BXP.PB) plans to redeem its lone outstanding preferred issue next week. Externally managed REIT Office Properties Income Trust (OPI) also has an exchange-listed bond. On average, these securities pay a current yield of 5.73% and trade at a slight premium to par value.

Key Takeaways: The New Normal

We believe that COVID-19 has simply accelerated - rather than temporarily altered - the pre-existing trends of increased workplace efficiency and technological disruption to the workplace in a magnitude not entirely unlikely the e-commerce disruption to the brick-and-mortar retail format seen throughout the 2010s. While we maintain a bearish sector-level outlook on office REITs due to a number of structural headwinds, we see pockets of value in Sunbelt and suburban-focused REITs as well as office REITs that cater more to "non-corporate" tenants (government, lab space) that are less impacted by WFH headwinds and are poised for a faster and more sustainable recovery.

The permanence of WFH trends and the ultimate recovery in office demand will be uneven across regions. Commute times will play a major role in determining how fast - and to what extent - employees return and dense coastal office markets with brutal transit-heavy commutes will struggle in the new normal. As WFH becomes the norm, the office sector's loss will continue to be the housing market's gain as households look for more living space - and dedicated home offices - to adapt and thrive in the new normal.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Storage, Timber, Prisons, Cannabis, Real Estate Crowdfunding, High-Yield ETFs & CEFs, REIT Preferreds.

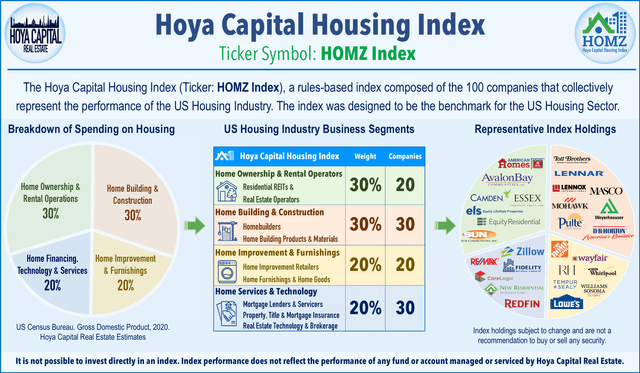

Disclosure: Hoya Capital Real Estate advises an Exchange-Traded Fund listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index. Index definitions and a complete list of holdings are available on our website.

Subscribe to The REIT Forum For the Full Analysis

Hoya Capital is excited to announce that we’ve teamed up with The REIT Forum to bring the premier research service on Seeking Alpha to the next level. Exclusive articles contain 2-3x more research content including access to The REIT Forum's exclusive ratings and live trackers and valuation tools. Sign up for the 2-week free trial today! The REIT Forum offers unmatched coverage and top-quality model portfolios for Equity and Mortgage REITs, Real Estate ETFs and CEFs, High-Yield BDCs, and REIT Preferred Stocks & Bonds.