Eric Francis/Getty Images News

What Is Berkshire Hathaway?

Berkshire Hathaway is one of the most profitable companies in the world. Since 1970, its Chairman and CEO has been "The Oracle of Omaha" himself, Warren Buffett, and since 1978, its Vice Chairman has been Charlie Munger.

Berkshire wholly owns such diverse companies as:

- GEICO: insurance

- Burlington Northern Santa Fe (BNSF): railroad

- Duracell: batteries

- Fruit of the Loom: underwear and casual clothing

- NetJets: private business jet fractional ownership

- Dairy Queen: fast-food restaurants

- Shaw Industries: carpet manufacturer

- Clayton Homes: maker of manufactured, modular, and mobile homes

- Long & Foster: real estate—the largest global affiliate of Christie's International Real Estate

In addition, Berkshire Hathaway owns large stakes in these companies:

- Bank of America: the second-largest bank in the U.S.

- Apple: computers and smartphone manufacturer

- American Express (Amex): credit card services

- Pilot Flying J: travel plaza owner and operator

- Kraft Heinz: maker of ketchup, Oscar Mayer hot dogs, and Philadelphia Cream Cheese

- Coca-Cola: manufacturer of concentrates and syrups sold the world over.

BRK.A vs. BRK.B

Berkshire Hathaway has two classes of shares:

Both are traded on the New York Stock Exchange. Originally, Berkshire Hathaway only offered one type of share (BRK) but, in 1996, when the share price jumped above $30,000, the only way many investors could afford the stock was by buying fractional ownership through unit trusts or mutual funds.

This state of affairs bothered Warren Buffett who wrote in his 1996 annual letter to shareholders:

"As I have told you before, we made this sale [of Class B] in response to the threatened creation of unit trusts that would have marketed themselves as Berkshire lookalikes. In the process, they would have used our past, and definitely non-repeatable, record to entice naïve small investors and would have charged these innocents high fees and commissions... Berkshire would have been burdened with both hundreds of thousands of unhappy, indirect owners (trust holders, that is) and a stained reputation."

To thwart the unit trusts, Buffett and the Berkshire board issued 517,500 Class B shares priced at 1/30th of the price of a Class A share. In 2010, Berkshire split their Class B shares 50-to-1, which meant that each Class B share was worth 1/1,500 of a Class A share and one Class A share could be converted into 1,500 shares of Class B stock.

In an effort to prevent price volatility caused by the supply of Class B shares, Berkshire's offering was open-ended, meaning that there was no limit to the number of shares that could be offered. As of March 2, 2022, there are 619,940 outstanding shares of Class A and 1.3 billion outstanding shares of Class B.

As of March 2, 2022, Berkshire's BRK.A shares were trading at an eye-watering $485,970.56, while its Class B shares were trading at $324.30. BRK.A shares are priced so high because Berkshire has never split their Class A shares, and the company has only paid a dividend once since 1970 when Buffett took his leadership position. Not paying a dividend allows Berkshire to retain its corporate earnings and continually reinvest money into growth.

The differences between BRK.A and BRK.B are:

- BRK.A shares have more voting rights than BRK.B shares which originally had 1/200th of the per-share voting rights of BRK.A shares, but that was later amended to 1/10,000th of the per-share voting rights of BRK.A shares.

- BRK.A shares can be converted into BRK.B shares, but BRK.B shares cannot be converted into BRK.A shares; to do so, a holder of BRK.B shares would have to sell them then buy BRK.A shares on the open market.

- BRK.B shares can be gifted or passed on to heirs without triggering a gift tax; in 2022, the maximum amount that can be gifted is $16,000, so almost 50 shares of BRK.B could be gifted or passed on to heirs without incurring a tax.

- They can perform somewhat differently, despite both being stakes in the same company. This is due to supply and demand issues, market dynamics, and the difference in investors, with BRK.A shares slightly outperforming BRK.B shares, however, this may not be the case in the future.

How To Buy Berkshire Hathaway Stock: 10 Steps

Note: This report is not a recommendation to purchase BRK.A or BRK.B. For investors who are interested in pursuing a potential investment, the following steps may be helpful.

Step 1: Understand Berkshire Hathaway's Finances & History

Read financial articles such as How Does Berkshire Hathaway Make Money? to learn about the company's finances and history.

Step 2: View Berkshire Hathaway's Financial Filings

Before investing in any stock, even one such as Berkshire Hathaway, it's a good idea to check their financial filings which can be found on the BERKSHIRE HATHAWAY INC. investor relations page. These filings include the company's:

Step 3: Use the Tools Provided by Investor Websites

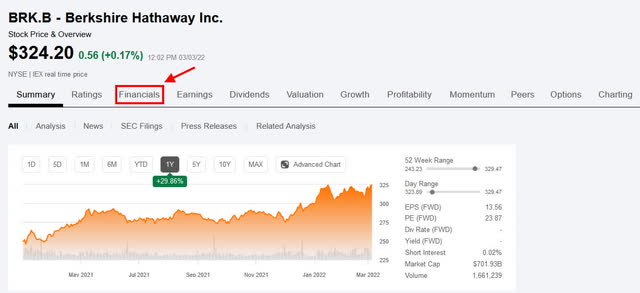

Investor websites such as Seeking Alpha provide access to valuation measures and other metrics. To find these tools on Seeking Alpha, enter a company's name or stock symbol such as "BRK.B" into the search box at the top of the Seeking Alpha homepage, then click on the "Financials" tab.

Seeking Alpha BRK.B Financials Tab (Seeking Alpha)

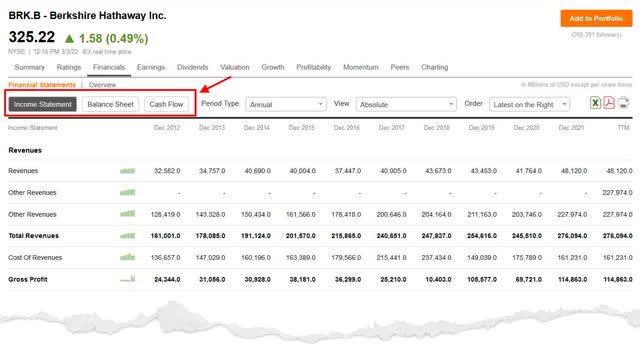

You can then view Berkshire Hathaway's income statement, balance sheet, and statement of cash flows by selecting from among the "Income Statement", "Balance Sheet", and "Cash Flow" tabs.

Seeking Alpha BRK.B Income-Balance-Cash Flow (Seeking Alpha)

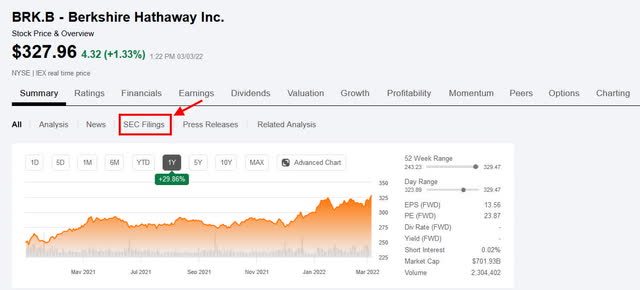

Step 4: View Berkshire Hathaway's SEC Filings

On Seeking Alpha's BRK.B detail page, click on the "SEC Filings" tab to view Berkshire Hathaway's 8-K and 10-Q reports, starting with the most recent.

Seeking Alpha BRK.B SEC filings (Seeking Alpha)

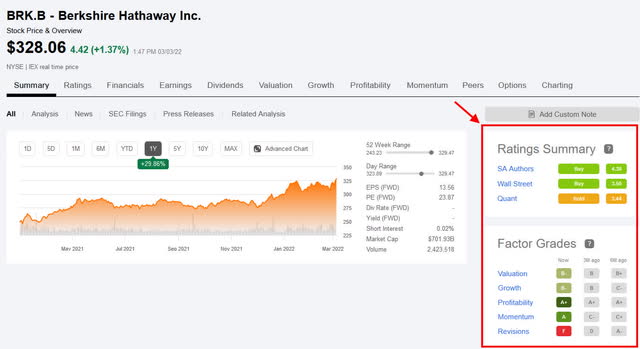

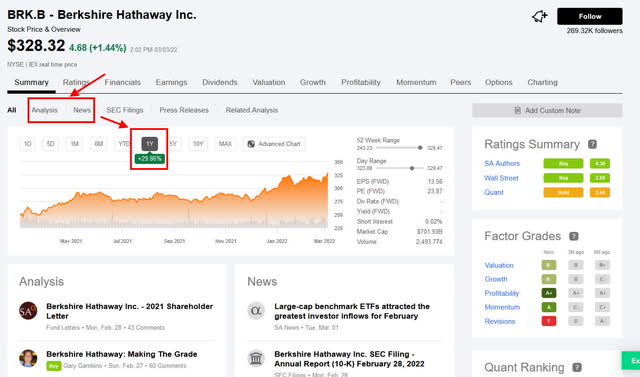

Step 5: Take Advantage of Ratings Summaries and Factor Grades

Investor websites such as Seeking Alpha provide ratings done by Seeking Alpha authors, Wall Street analysts, and quants. Seeking Alpha also provides Factor Grades, with both appearing along the right-hand side of BRK.B's detail page.

Seeking Alpha BRK.B Ratings Summary and Factor Grades (Seeking Alpha)

"Quant" is short for "quantitative analyst", and is a financial analyst who uses mathematics and complex algorithms to analyze financial instruments, such as stocks, bonds, and insurance.

Step 6: View a Stock's Behavior Over Time

It's important to view a stock's behavior over time then compare it to your investment horizon. This is the amount of time you plan to hold an investment before selling it. For example, a long-term investment would be one made at the birth of a child for that child's college education and would have an 18-year investment horizon. You can view Berkshire Hathaway's behavior over time by selecting one of the "Time" tabs on the BRK.B detail page, then clicking on the "Analysis" and "News" tabs.

Seeking Alpha BRK.B Time Analysis and News (Seeking Alpha)

Step 7: Select a Brokerage

An investor can select from among discount brokers whose costs are low but who provide few services, and from among full-service brokers who provide portfolio management and advisory services, but who may charge a higher commission. Once a brokerage is selected, an investor can open a trading account or a retirement account, such as an IRA.

Step 8: Choose an Investment Strategy

Investors must decide how many shares to buy, how long they intend to hold those shares, and how they will sell them. How they will sell their shares is known as an exit strategy. Some investment strategies involve short-term trading, others involve swing trading, and still others involve long-term holding. Swing trading focuses on short-term trends that occur over the course of greater than one day but only up to several months.

Step 9: Choose an Order Type

The main order types are:

- Market order: an order to execute a trade immediately at the best available transaction price; it is the most common type of order placed by investors

- Limit order: an order to execute a trade only at a specified maximum price per share

- Stop order: also known as a stop-loss order, it is an order to buy or sell a stock once it reaches a specified price which is known as the stop price. A buy stop order might be triggered once a stock rises to a specified price, or a sell stop order might be triggered if a stock falls below a specified price.

Step 10: Submit the Trade

The time when investors used to yell into their phones, "Buy!" or "Sell!" is long gone. Today, most trading is done electronically, and submitting a trade may involve nothing more than clicking on a button. Either way, by trading, you're part of the exciting world of investing.

Bottom Line

Whether you have the luxury of affording Berkshire Hathaway Class A shares, or you can only afford only a couple of Class B shares, few companies can compete with Berkshire Hathaway's consistent annual returns which since 1965, have averaged 20%. This is almost double the annual returns of the S&P 500. While past performance is no guarantee of future performance, Berkshire Hathaway would be a great addition to a portfolio, especially for long-term investors.