kickers

Overview

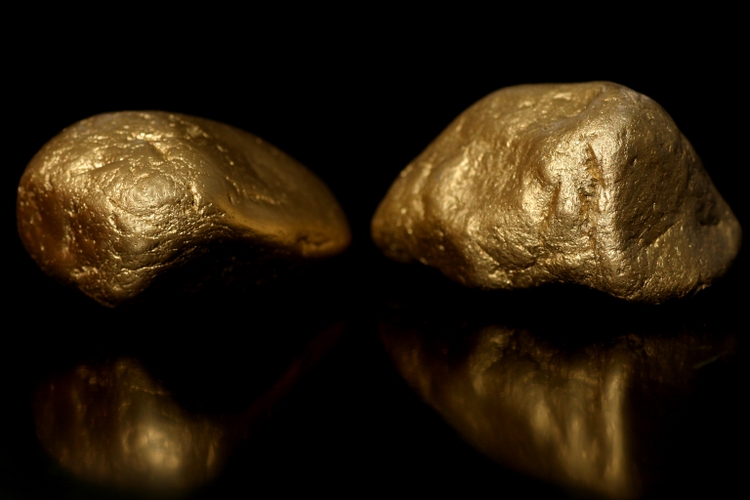

Lundin Gold (OTCQX:LUGDF) is a mid-cap gold mining company listed in Canada (TSX:LUG:CA) and Sweden, which is headquartered in Vancouver, BC, Canada. The reporting currency is U.S. Dollars. The company is a single asset producer that owns the low-cost Fruta del Norte

If you like this article and are interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio generated a return of 81% during 2020, 39% in 2021, -8% in 2022, and 12% in 2023.