This article was written by

HFIR Research is a full-time professional energy investor, active in the sector since 2015 while specializing in deep value opportunities and special situations. He has managed a private investment partnership since 2007 and has a long professional history in finance, having served in various roles in the industry since 2000.

He runs the investing group

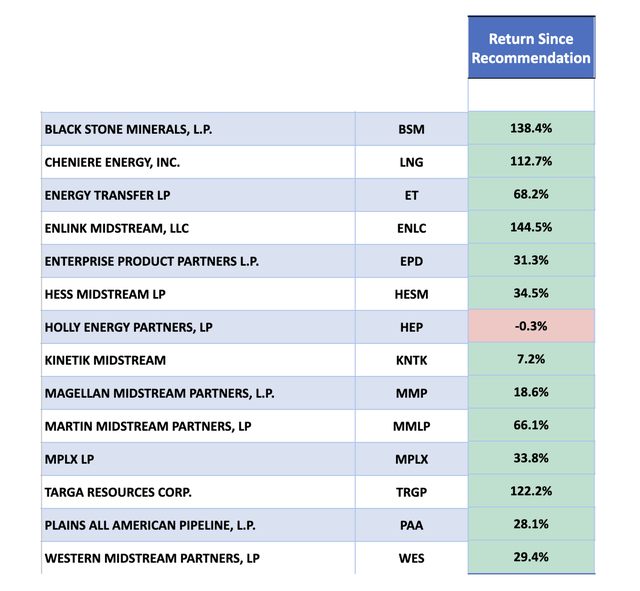

HFI Research Energy Income where he works to outperform the benchmark of the Alerian MLP Index, by investing in energy stocks for income and growth. Features of the service include: 4-6 exclusive idea write-ups per month, real-time portfolio tracking including what to buy, when the dividend will be paid, tax implications and positional weighting, fundamental data pertaining to MLPs, and 24/7 direct communication with the HFI Research team to ask questions.

Learn more.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVE, SU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.