This article was written by

Juan de la Hoz has worked as a fixed income trader, financial analyst, operations analyst, and as an economics professor. He has experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs.

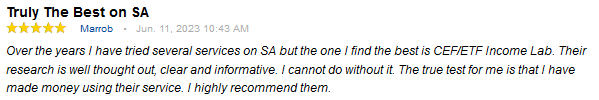

Juan is a contributor to the investing group CEF/ETF Income Laboratory which is led by Stanford Chemist. Features of the service include: managed income portfolios (targeting safe and reliable ~8% yields) making use of high-yield opportunities in the CEF and ETF fund space. These are geared toward both active and passive investors of all experience levels. The vast majority of CEF/ETF Income Laboratory holdings are also monthly-payers, for faster compounding and steady income streams. Other features include 24/7 chat, and trade alerts. Learn More.

Analyst’s Disclosure:I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.